The ETF Industry saw 41 New Launches and 5 Closures last week. This week’s KPI data overview highlights key metrics and trends shaping the ETF landscape:

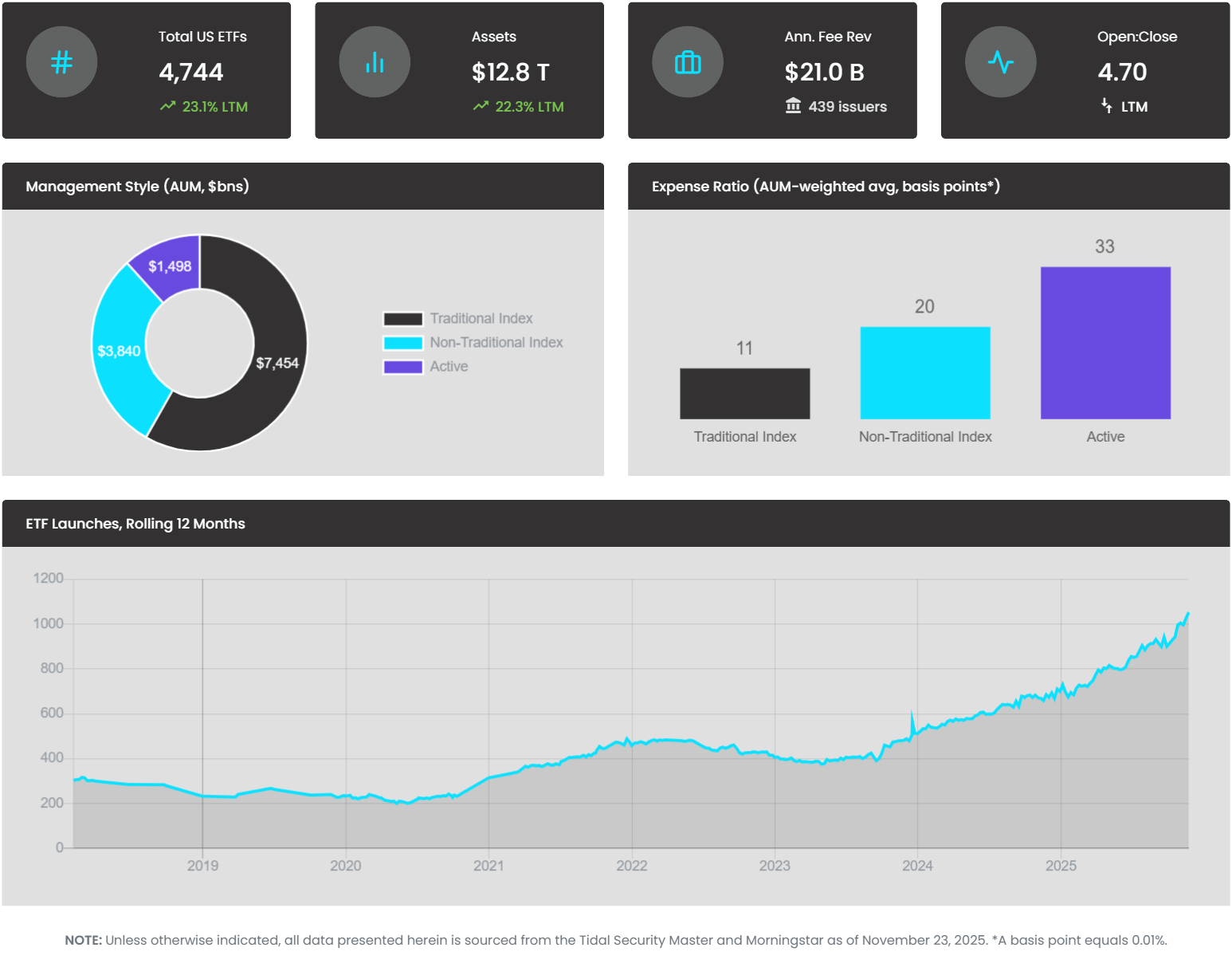

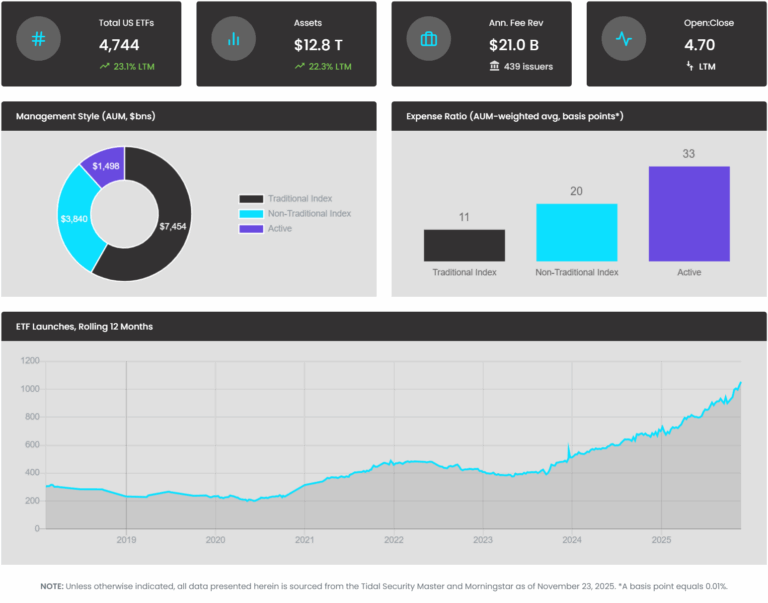

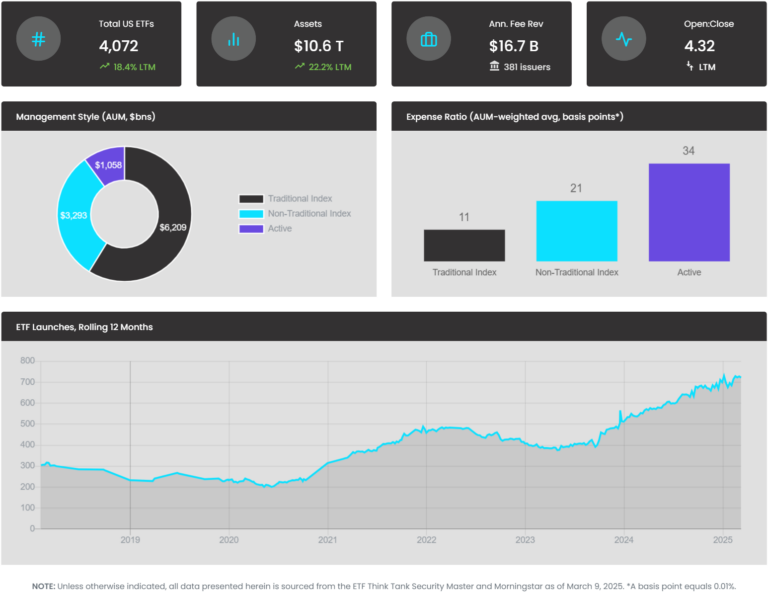

- The current 1-year ETF open-to-close ratio has increased to 4.70.

- There are now 4,744 U.S.-listed ETFs in the market.

- The annual ETF expense revenue has decreased to $21.0 billion.

- A total of 1,053 ETFs have been launched over the past twelve months.