Tax efficiency has been one of the most celebrated traits of the ETF wrapper, and a legitimate source of structural alpha relative to other investment vehicles.

In a nutshell, most ETFs don’t distribute capital gains most years, unlike other vehicles such as mutual funds.

This trait generally offers several tangible investor benefits, including the potential for: lower tax liabilities, greater after-tax returns, and fewer surprises at year-end.

The Engine Behind the Wrapper: In-Kind Creation/Redemption

Behind that transactional “magic” is a unique creation/redemption mechanism that powers up the supply of ETF shares. Originally designed to allow ETFs to keep share prices closely aligned with NAV, this mechanism also unlocks tax efficiency.

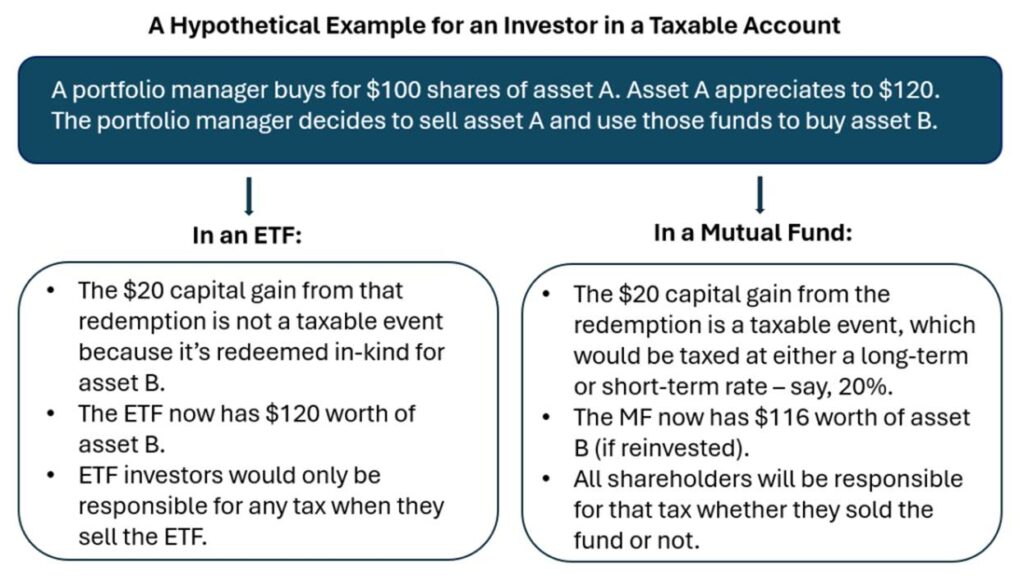

Here’s how it works: ETF shares are created and redeemed in the primary market by Authorized Participants (APs), who interact with ETF issuers. APs can exchange baskets of securities (creation baskets) for ETF shares or redeem ETF shares in-kind for the underlying holdings. These in-kind transactions don’t trigger capital gains events because no cash changes hands, there’s no realized sale.

This mechanism stands in contrast to mutual funds, which generally sell securities for cash when faced with redemptions, resulting in potential taxable gains. While mutual funds can process in-kind redemptions, the process is cumbersome and rarely used due to overnight trade risk and operational friction.

Custom Baskets and the Tax Alpha Advantage

ETF issuers and APs have discretion in selecting which securities go in and out of the portfolio during creations and redemptions. This opens the door to strategic tax management.

Through the use of custom baskets, non-pro rata selections of securities, issuers can target securities with the most embedded gains for redemption. This increases the portfolio’s cost basis over time, effectively “washing out” gains without triggering taxable events.

Rule 6c-11, introduced by the SEC in 2019, codified this ability. It allows both active and passive ETFs to utilize custom baskets, provided they have adopted and implemented policies to do so in a manner that suits the best interest of shareholders.

The result?

Capital gains can be removed via in-kind transactions rather than being realized within sale transactions in the fund. Investors typically won’t face tax consequences until they decide to sell their ETF shares.

When Efficiency Isn’t Perfect

ETF tax efficiency isn’t foolproof. While around 96%1 of ETFs avoid capital gains distributions in most years, there are always outliers.

Certain asset classes, like foreign equities, fixed income, derivatives, and crypto, often face hurdles to in-kind transactions. Whether due to market access, illiquidity, or regulatory constraints, these funds may be forced to transact in cash during the creation or redemption process, therefore triggering taxable events.

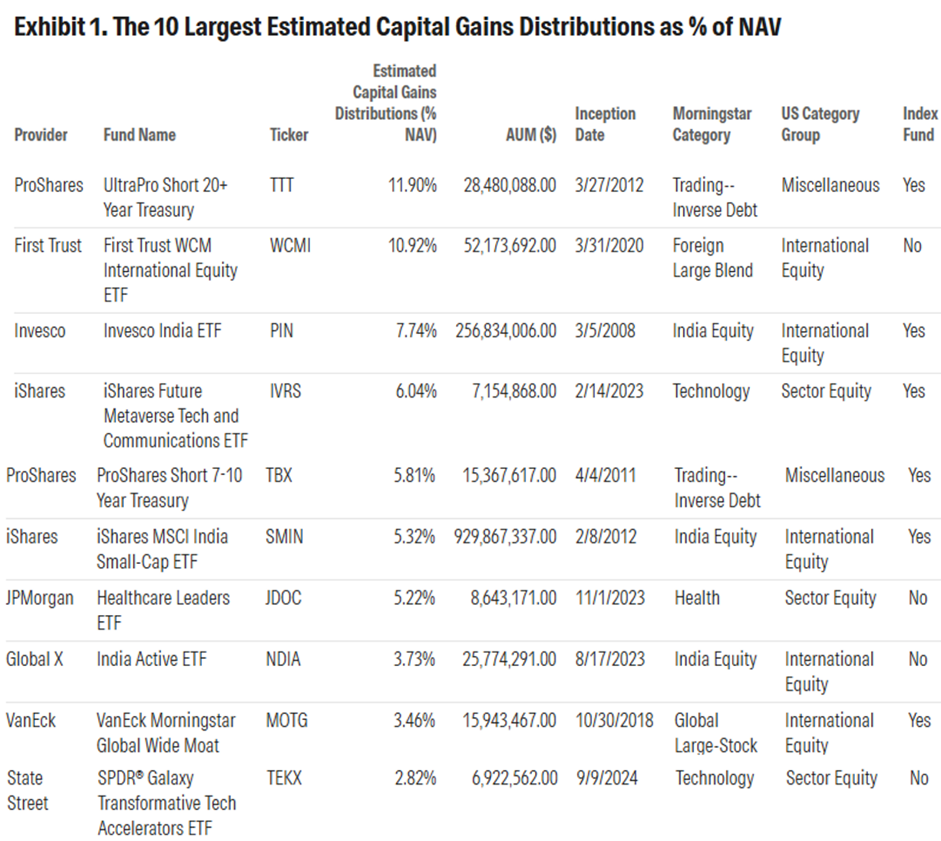

Execution matters too. Portfolio managers who don’t optimize tax management through custom baskets or tax loss harvesting may inadvertently generate gains. Morningstar tracks these capital gains distributions annually, and the data shows consistent patterns: U.S. equity ETFs are rarely affected, while more complex strategies are more likely to produce taxable capital gains events.

Via Morningstar.com – Data as of 11/30/2024

Tax Loss Harvesting and Tactical Tools

Tax loss harvesting adds another layer of potential ETF tax optimization. Portfolio managers can strategically realize losses via cash redemptions, then carry those losses forward to offset potential future gains.

Fixed income and emerging market ETFs often benefit from this strategy. In bonds, where income is taxed differently than appreciation, even cash redemptions tend to sidestep capital gains. In emerging markets, where in-kind settlement may be unavailable, tax loss harvesting becomes critical.

Derivatives and crypto ETFs present the most consistent challenges to tax efficiency. These wrappers typically cannot redeem in-kind, limiting the ability to manage gains internally. Nonetheless, loss harvesting and smart execution can still play a role.

Active vs. Passive: Does It Matter?

The short answer is yes.

According to Qiao Duan, VP of Portfolio Management and Trading at Tidal, passive ETFs have the advantage of predictability and fewer rebalances, which helps tax planning. “We can arrange a CIB (custom in-kind basket) ahead of scheduled index changes,” she explains.

Active funds offer greater flexibility but require bespoke solutions. “Trading styles differ widely. Some funds rebalance fully, others trade incrementally. Our job is to evaluate and guide fund rebalances to the most tax-efficient outcomes.”

Structural Quirks That Matter

ETF tax efficiency can also be impacted by portfolio design and entity structure:

- PFICs (Passive Foreign Investment Companies): Certain non-U.S. companies can trigger adverse tax treatment regardless of wrapper.

- Cayman Subsidiaries: Used in commodity ETFs to hold futures, these offshore entities can’t process in-kind trades and often generate ordinary income.

- REITs, MLPs, and ’40 Act ETFs owning ’33 Act ETFs: These structures can lead to UBTI (Unrelated Business Taxable Income), potentially triggering taxes in otherwise tax-deferred accounts.

The Bottom Line

Tax efficiency remains one of the most compelling structural advantages of the ETF wrapper. But it isn’t automatic. It requires the right tools, partners, and precision.

This is where Tidal Financial Group can bring significant value. Our active trading and portfolio management teams help issuers to precisely navigate tax-sensitive exposures. From custom basket optimization to tax loss harvesting and regulatory structuring, Tidal is built to help clients capture the full benefits of the ETF wrapper.

Whether you’re launching a passive strategy or managing an active mandate, Tidal’s infrastructure and hands-on service helps empower you to deliver efficiency by design, not by accident.

1 https://www.morningstar.com/funds/good-news-etf-investors-capital-gains-distributions-remain-low