Buffered ETFs are designed to help investors manage risk while remaining invested in the market. A Buffered ETF is a type of defined outcome ETF designed to protect investors from a certain percentage of market losses while still allowing them to participate in market gains, though with a cap on the upside. These ETFs typically track an index (like the S&P 500) and use options strategies to create a “buffer” against losses, usually over a 12-month period.

For example, if a Buffered ETF offers a 10% buffer, it will protect the investor from the first 10% of losses, but any losses beyond that threshold are borne by the investor. In exchange for this downside protection, gains are capped at a predetermined level.

Buffered ETFs are appealing to conservative investors looking for downside protection while still participating in the equity markets.

In today’s unpredictable market, where recession warnings have been a constant presence for nearly two years, yet the stock market keeps hitting record highs, it’s no surprise that demand for buffered ETFs is on the rise.

Investors are faced with a conflicting economic landscape and are increasingly turning to these strategies to remain invested while enjoying a balanced approach that offers both downside protection and the opportunity for potential gains.

Behind the numbers

The Buffered ETF industry has experienced significant growth over the past year. Assets under management (AUM) have surged from $23.9 billion across 121 funds to $41.4 billion across 205 funds year-over-year, supporting the rising demand for these risk-managed investment strategies.

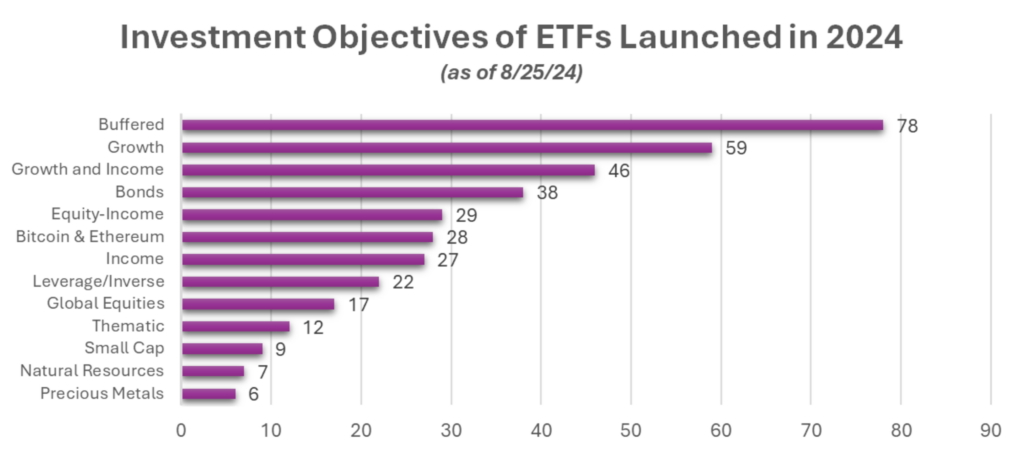

In 2024, Buffered ETFs emerged as the most frequently launched products in the ETF industry. As of August 25th, 78 of these ETFs have been introduced, accounting for roughly 20% of all new strategy launches.

Many of these funds come from two key players in the buffered ETF space: Innovator and PGIM, who together account for 57 launches since December 29th.

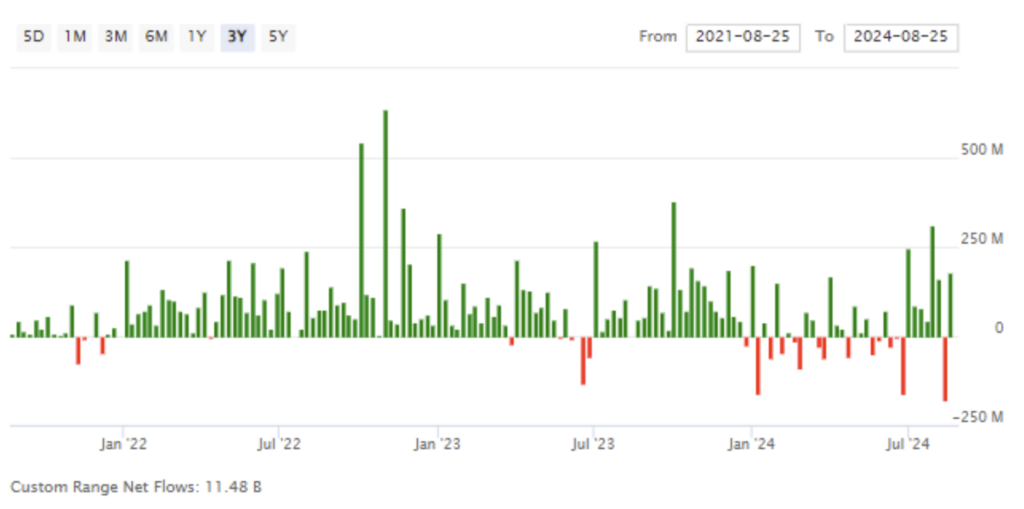

Innovator, in particular, has carved out a niche specializing in buffered products. Out of the 136 ETFs they offer, approximately 75% are focused on the Buffered Strategy. Over the past three years, Innovator’s assets under management (AUM) have surged from around $8 billion to $19.5 billion, reflecting an impressive compound annual growth rate (CAGR) of roughly 38%. The consistent growth of their AUM highlights strong investor demand, and Innovator has capitalized significantly by focusing on the buffered ETF strategy.

PGIM is making significant strides in expanding its presence in the ETF space in 2024. While PGIM currently offers 42 ETFs, 26 of these are Buffered ETFs launched this year, yet the firm has only accumulated approximately $146 million in assets under management (AUM).

Despite this modest start, PGIM’s parent company, Prudential Financial, ranks as the 14th largest investment manager globally, overseeing more than $1 trillion in AUM. With such backing, PGIM is positioning itself to become a key player in the Buffered ETF movement.

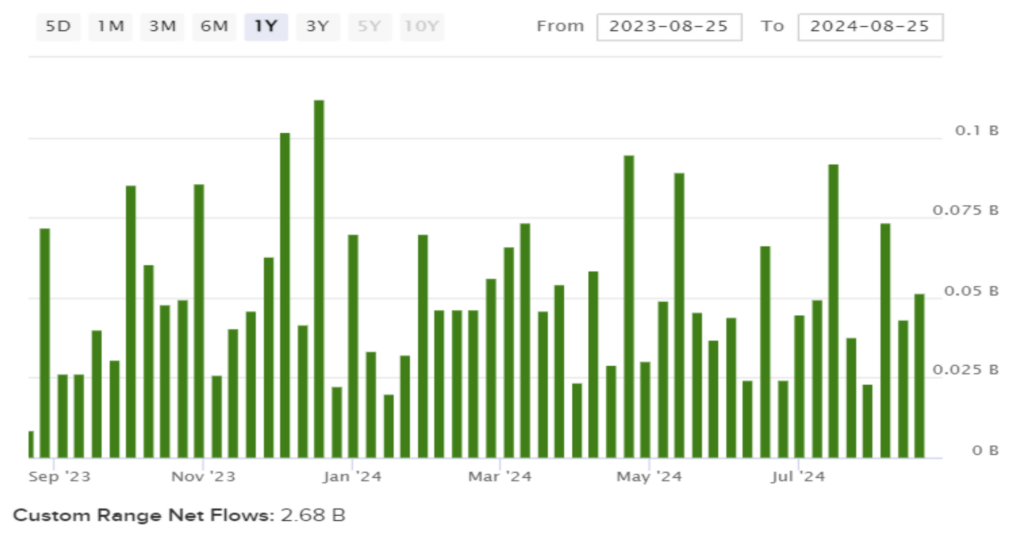

The largest player in the Buffered ETF space, by a significant margin, is First Trust. Since entering the Buffered ETF market in 2019, First Trust has grown to offer 60 ETFs in this category, amassing approximately $22 billion in assets under management (AUM). Among these, the most notable is the FT Vest Laddered Buffer ETF (BUFR), which stands out as the most popular ETF in the space with around $5 billion in AUM. Interest in BUFR has surged over the past year, with its AUM more than doubling from $2.32 billion to $5 billion.

As the Buffered ETF space continues to grow, the potential for innovation and competitive advantage remains strong, particularly when considering the fee structures within this market.

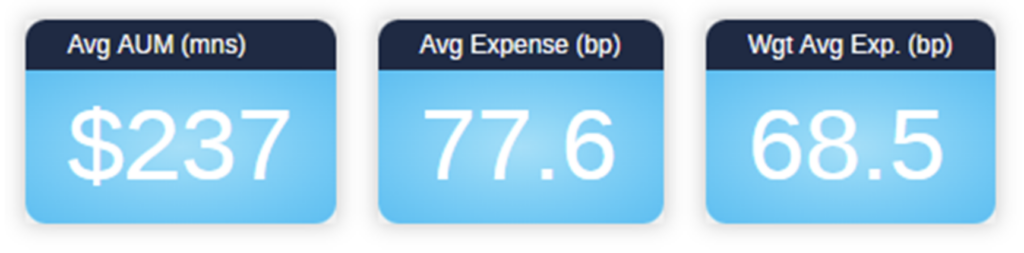

Buffered ETFs typically command fees ranging from 65 to 85 basis points, with an average of 77 basis points and a weighted average of 68 basis points across assets. These fees have remained elevated due to the active, complex nature of the products, and competition in fees has been limited. However, this space is poised for innovation and new offerings, presenting a significant growth opportunity for issuers.

The real question is whether this strong momentum will persist, or if changing market conditions and investor preferences could slow the growth of these strategies in the coming years.

Launching a successful ETF requires navigating a complex landscape of strategy, innovation, and timing. While it is not without its challenges, with the right expertise and a well-crafted plan, the opportunity for success is significant. If you’re considering bringing a fresh solution to market or expanding your presence in this growing space, launching an active and complex ETF, like a Buffer ETF, could be the next step.

All data is based from August 25th, 2024

Sources:

https://etfdb.com/etf-fund-flows/#issuer=innovator

https://www.pgim.com/investments/pgim-target-date-funds