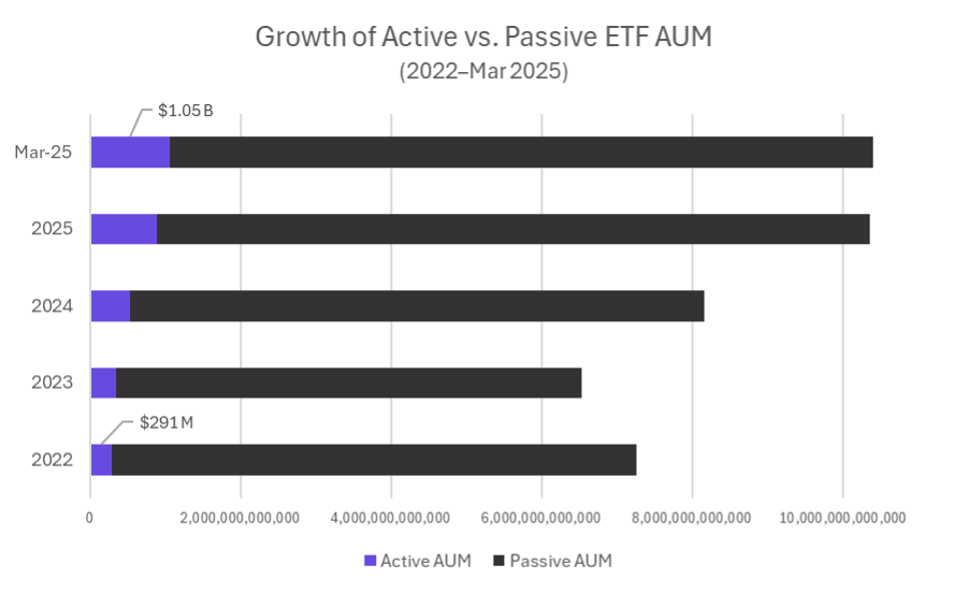

The active ETF space has officially crossed the $1 trillion mark in the United States, a historic milestone that reflects how far this segment has come, and how rapidly investor preferences are evolving.

Once a niche corner of the ETF world, active strategies now account for approximately 11% of total US ETF AUM and in 2024, made up a striking 78% of all new ETF launches in the U.S.

Last year alone, active ETFs captured 26% of total industry flows, with their market share growing at a pace of 34%, underscoring the accelerating demand for flexible exposure beyond traditional benchmarks.

With global assets now surpassing $1.3 trillion and the pace of launches accelerating, active management within the ETF wrapper is slowly becoming a defining feature of the ETF landscape.

At Tidal Financial Group, we’ve long recognized this shift.

With over 70% of the ETFs on our platform actively managed, our infrastructure, legal experience, and operational agility are purpose-built to support the unique demands of active strategies.

As an experienced partner in the space, Tidal has helped shape this evolution, proving that innovation and active management can thrive within the ETF structure.