The numbers tell a story that the asset management industry can no longer ignore.

In 2025, just 95 new mutual funds launched in the United States, a 52% decline from the prior year and the lowest figure since 1983, according to Morningstar Direct data. In that same period, more than 1,100 new ETFs came to market, shattering the previous annual record. At this point, calling it a trend undersells what is happening.

For decades, mutual funds were the default vehicle for American investors. They powered 401(k) plans, anchored financial planning conversations, and served as the entry point for millions of first-time investors. But the data from 2025 confirms what industry observers have long suspected: the mutual fund era is giving way to something faster, more transparent, and more tax-efficient.

A Steady Decline Becomes a Freefall

Mutual fund launches have been sliding for the better part of a decade, down from 534 debuts in 2015. But the drop to 95 in 2025 marks a steeper decline than simple cyclical slowdown can explain. The vehicle that once dominated American investing is now being treated as a specialized tool rather than a default choice.

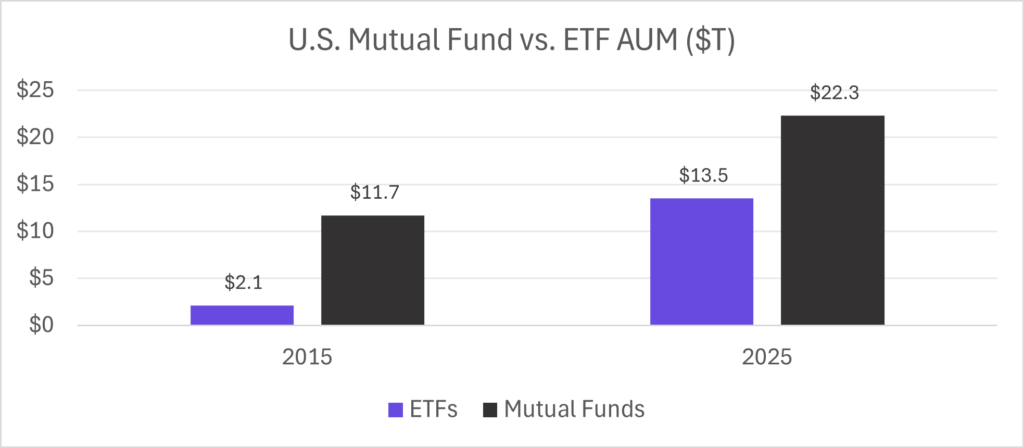

The flow data reinforces this picture. Investors pulled more than $608 billion from mutual funds in the year ended November 2025, while U.S.-listed ETFs attracted a record $1.49 trillion in net inflows for the full calendar year, shattering the prior record of $1.12 trillion set in 2024. Traditional mutual funds still held $22.3 trillion in assets as of late November, compared to $13.5 trillion for ETFs. But a decade ago, mutual funds held $11.7 trillion versus just $2.1 trillion in ETFs. The gap is closing fast.

Source: Morningstar Data

A Record Year for ETF Innovation

The 2025 ETF launch boom was remarkable by any measure.

An all-time high of 1,138 new ETFs began trading during the year, according to Morningstar Direct, bringing the total number of primary U.S.-listed ETFs to nearly 5,000, exceeding the number of publicly listed stocks for the first time. A record 962 of those launches were actively managed, representing roughly 83% of all new ETFs for the year, and for the first time, the number of active ETFs in the U.S. surpassed the number of passive ETFs. In total, active strategies captured approximately $475 billion in net inflows, about one-third of the $1.49 trillion that flowed into U.S.-listed ETFs across all categories. Total assets ended the year at $13.5 trillion.

Why the Shift Is Accelerating

The core structural advantages of ETFs, including intraday liquidity, tax efficiency through in-kind creations and redemptions, and generally lower expense ratios, have been well documented for years. There is also a generational component. Younger investors are entering the market with ETFs as their default, and as that cohort grows as a share of total assets, the gravitational pull toward the ETF wrapper should only strengthen. What changed in 2025 is the degree to which the industry began acting on these dynamics all at once.

Mutual fund-to-ETF conversions hit a record pace. 60 mutual funds converted to ETFs during the year, the most in any single year since the first conversion took place in 2021. In total, 190 conversions have been completed since that initial wave, producing cumulative net new flows of more than $77 billion into the converted products. Major firms including Goldman Sachs, Morgan Stanley, Franklin Templeton, and AllianceBernstein all executed conversions in 2025, spanning equity, fixed income, and municipal bond strategies.

Perhaps the most consequential development of the year, however, was the SEC’s November approval of Dimensional Fund Advisors’ application to offer ETF share classes within its existing mutual fund structure, making it the first firm after Vanguard to receive this exemptive relief and the first to apply it to actively managed products. The decision broke a regulatory logjam that had been building since Vanguard’s patent on the dual share class model expired in 2023. Within weeks, more than 60 additional asset managers refiled their own applications for substantially identical exemptive relief, with more than 80 total firms now in the queue. If those approvals follow at the pace the SEC has signaled, the result could be a wave of new ETF share classes layered onto trillions of dollars in existing mutual fund assets.

Looking Ahead

ETFs now represent 37% of combined ETF and mutual fund assets, and at the current trajectory, the number of ETFs is projected to exceed the number of mutual funds by early 2027. The dual share class structure, record conversions, and an ongoing flood of new active launches all point in the same direction. The ETF wrapper has gone from nice-to-have to more of a non-negotiable.

For firms navigating this shift, Tidal Financial Group partners with asset managers to design, launch, and operate ETFs efficiently, providing the operational backbone and regulatory experience to bring investment ideas to market in the wrapper investors increasingly demand.