The ETF industry had another busy week to start off 2025, highlighted by 25 Launches, 1 ETF Ticker Change, and 1 Closure.

This week’s KPI data overview highlights key metrics and trends in the ETF industry.

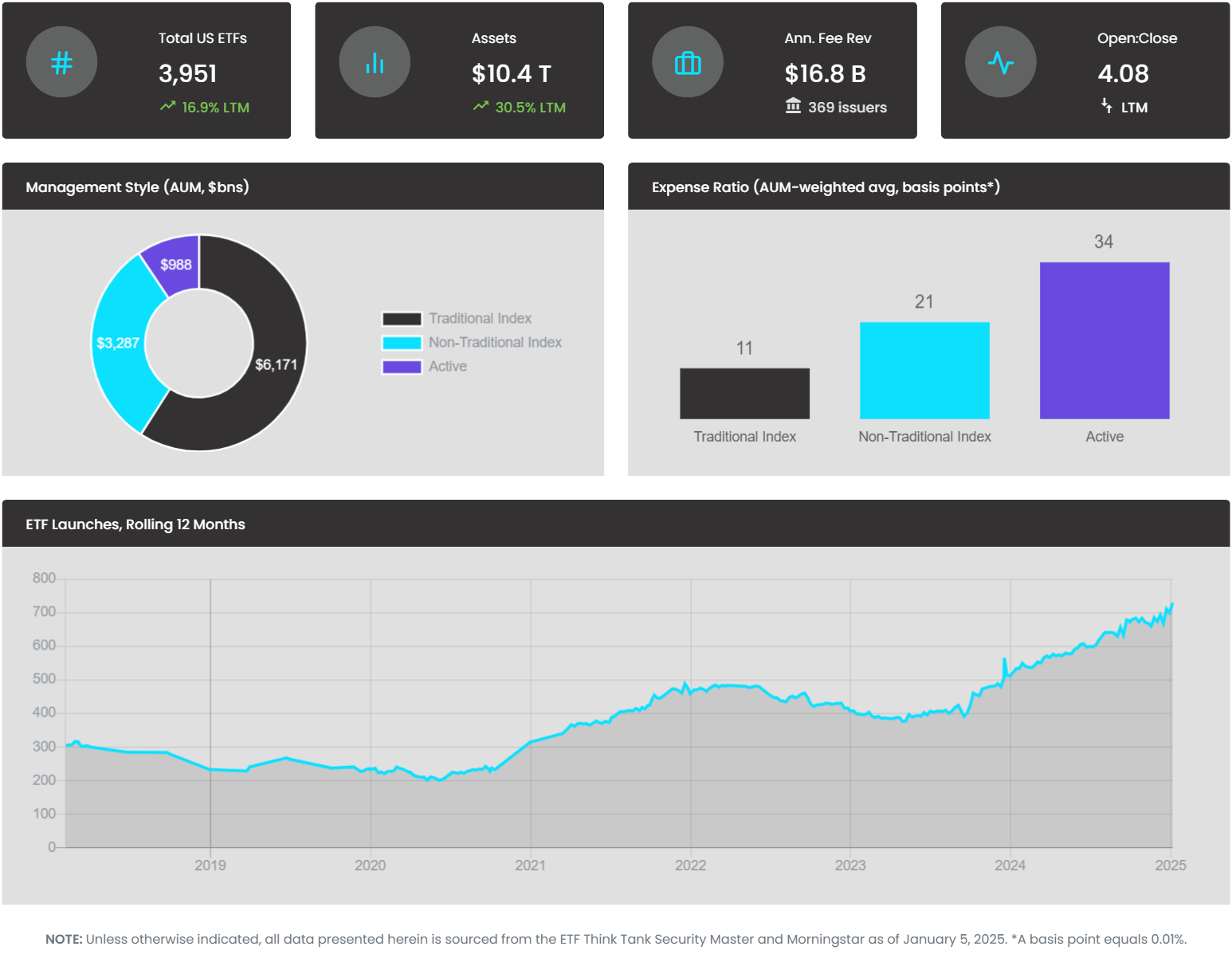

- The current 1-Year ETF Open-to-Close ratio sits at 4.08, doubling last year’s ratio of 2.02

- The total number of US ETFs has increased to 3,951, marking a 17% increase year over year.

- US Assets in the ETF Industry are flying high at $10.4 Trillion

- Annual ETF revenue has grown by 31% since last year, reaching $16.8b.