Understanding the Wrapper Magic

Tax efficiency has been one of the most celebrated traits of the ETF wrapper, and a legitimate source of structural alpha relative to other investment vehicles.

In a nutshell, most ETFs don’t distribute capital gains most years, unlike other vehicles such as mutual funds.

Behind that transactional “magic” is a unique creation/redemption mechanism that powers up the supply of ETF shares. Originally designed as a mechanism to allow ETFs to keep their share prices closely aligned with the net asset value of their underlying holdings throughout the trading day, the creation/redemption mechanism unintentionally unlocked tax efficiency too.

Herein lies the magic: ETF shares are created and redeemed in the primary market by Authorized Participants (APs), who interact with ETF issuers, exchanging securities for ETF shares as demand dictates. When more ETF shares are needed, APs exchange baskets of securities (creation baskets, as they are known) for ETF shares with issuers – shares that they will place in the secondary market for you and me to trade all day long. When fewer ETF shares are needed, APs hand shares to issuers in exchange for the underlying holdings – a process we know as redemptions. These securities-for-shares exchanges happening intraday are typically in-kind rather than in cash. That’s crucial for tax efficiency.

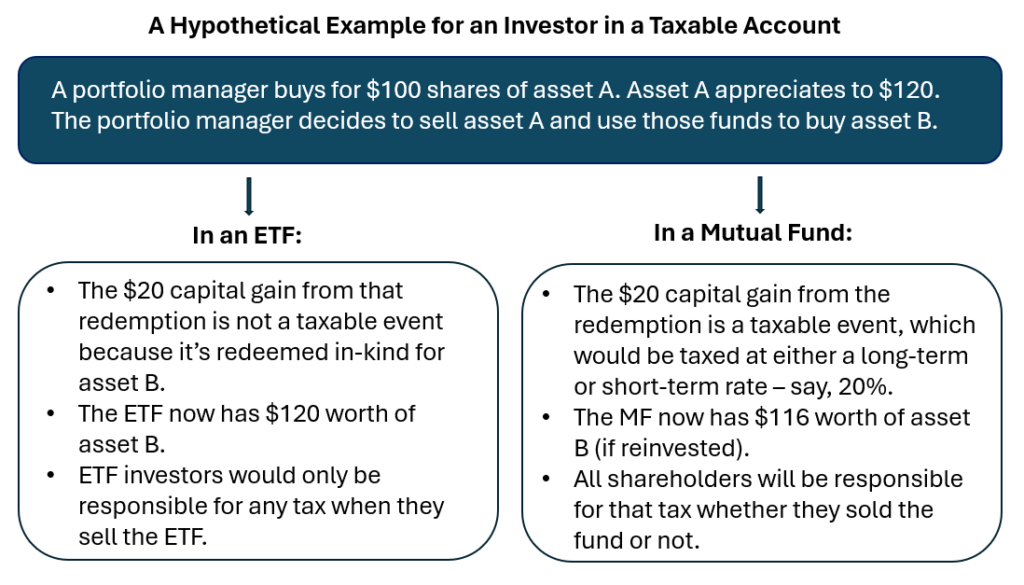

Why? When you settle a transaction in cash, you must realize a gain or a loss, which is a taxable event. Mutual funds, for example, typically sell positions for cash when they are faced with redemptions from a shareholder. In-kind transactions are theoretically possible in mutual funds but difficult and rare because they must be done overnight, so they carry a lot more transactional risk. ETFs, however, can avoid realizing gains to meet redemptions because, through in-kind exchanges throughout the trading day, issuers can redeem gains with the AP rather than having to sell them within the fund.

These exchanges can be quite optimized, too. Issuers and APs have discretion on which securities they choose to exchange when they are transacting. This discretionary security selection allows the ETF to manage the cost basis of the portfolio regularly – issuers and APs can consistently unload securities with most appreciation, increasing the costs basis of the basket. Come exit (tax) time, a lot of embedded gains that might have been in a fund have been washed out overtime.

Known as custom baskets, this type of portfolio management optimization was originally only a tool for passive index-tracking ETFs. But in 2019, the SEC changed that with Rule 6c-11 under the 1940 Investment Act (The “ETF Rule”) where it extended permissions for both passive and active ETFs to rely on custom baskets, among other things.

The commission explains it as this: “An ETF relying on rule 6c-11 will be permitted to use baskets that do not reflect a pro-rata representation of the fund’s portfolio or that differ from the initial basket used in transactions on the same business day (“custom baskets”) if the ETF adopts written policies and procedures setting forth detailed parameters for the construction and acceptance of custom baskets that are in the best interests of the ETF and its shareholders. The rule also will require an ETF to comply with certain recordkeeping requirements.”

The outcome of this tax efficient design is that ETF investors are rarely faced with distribution of capital gains, and they aren’t faced with a taxable event until they themselves take action – sell their position in the fund. That’s something most mutual fund investors are hit with regularly whether they themselves sell out of a fund or not.

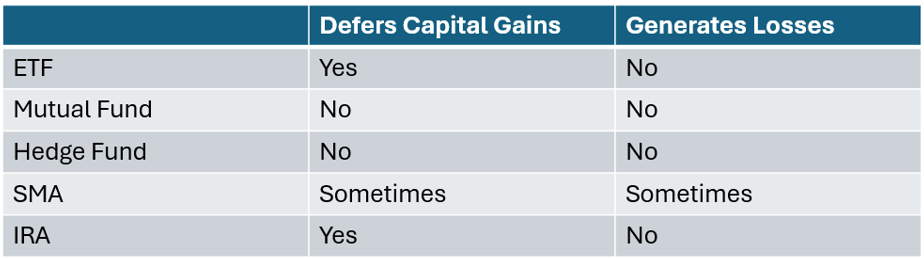

In fact, it isn’t only relative to mutual funds that ETFs demonstrate this efficiency. Other investment vehicles, too, aren’t as tax efficient in their design:

When Efficiency Isn’t Quite There

ETF tax efficiency isn’t always bulletproof.

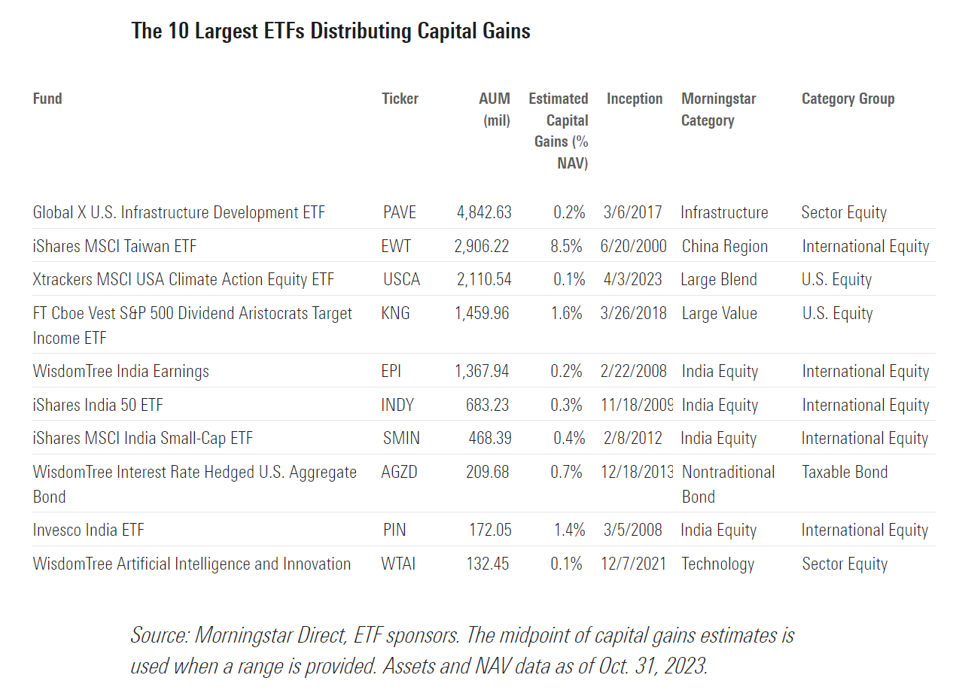

Most years, about 95% of ETFs don’t distribute any cap gains. But there’s always a group of ETFs that does, either because their portfolios can’t always transact in-kind – structural hurdles – or because their portfolio managers didn’t execute transactions in the most efficient way – user error.

Morningstar does a great job tracking that data every year. Consider their stats for 2023:

Source: Morningstar

In US equity ETFs, in-kind transacting is easy. But in foreign equities, in fixed income, in futures/derivatives, in crypto, tax efficiency can sometimes be a little trickier because transacting in-kind isn’t always possible.

These types of ETFs can more easily land in lists like Morningstar’s cap gain distributors (above). And they often require an expert portfolio management/trading hand to achieve the best results.

Tax Loss Harvesting

Consider foreign markets, like emerging markets, for example. It’s not always possible to transact in-kind in certain securities in these countries. When that’s the case, transacting cash-in-lieu of securities (CIL) is an option, but it can trigger a taxable event. And sometimes it is, unavoidably so. However, the ETF wrapper is equipped to handle this type of challenge through what’s known as tax loss harvesting.

A portfolio manager can harvest losses by redeeming in cash instead of in-kind. They can then preserve the loss and carry it forward, using it to balance against any possible capital gains in other (not-in-kind) positions within a portfolio to ensure that they don’t have an aggregate capital gain position at the end of the year that may require tax payment.

The same can happen in fixed income ETFs. A lot of bonds are in-kind redeemable, and when they are not, it’s often the case that, even in a cash redemption, bond gains come mostly from income and not from appreciation. That means a bond’s qualified returns are not taxable as capital gains. Tax efficiency wins again.

As a general rule of thumb, complexity in an ETF portfolio doesn’t bode well for perfect tax efficiency. Ask an ETF trader, and they’ll probably tell you that there’s no such thing as in-kind transacting in a portfolio comprising derivatives and only derivatives. Futures, swaps and crypto assets remain areas where tax efficiency is difficult. Options-based ETFs will also give a portfolio manager a run for their money, but tax loss harvesting remains a valuable tool for portfolio managers transacting in most ETF asset classes.

Does it matter if a fund is passive or active when it comes to tax efficiency? Yes, according to Qiao Duan, VP of Portfolio Management and Trading at Tidal. She says:

For passive funds:

- Pros: “They have a set schedule for rebalance – index providers send out the target weights a few days before the rebalance date, so we have enough time to do the tax analysis and arrange a CIB (creation-in-basket) if needed. Also, they tend to trade/rebalance less frequently with higher turnover, which makes CIB easier.”

- Cons: “They’re less flexible. We need to stick to the index to minimize tracking, which leaves us little room for tax harvesting outside of rebalance window.”

For active funds:

- “Advisors’ trading style heavily impacts the process of tax management. For example, some clients prefer sending a few small trades multiple times a week and others just send out a new portfolio for a full rebalance; Some are okay with the 3-day process for CIBs and others are more concerned with market risk and prefer to take the gains and exit the market right away. We need to evaluate and provide recommendations to clients, so they make the decision.”

- Pros: “Flexibility.”

- Cons: “May not always achieve the optimal tax outcome.”

The Other Quirky Stuff

There are a lot of other little things that can throw tax efficiency – and taxable events – for a loop. Here are a few examples.

Passive foreign investment company (PFIC).

To borrow Greenback Tax Expat Services description, a PFIC is “a non-US pooled investment company that attributes at least 75% of its gross income as passive income or at least 50% of its assets produce passive income.”

A PFIC is not regulated by U.S. law, but its designation is intended to ensure that no U.S. citizen skirts taxes by investing through foreign accounts or in foreign companies outside U.S. regulation. ETFs listed abroad can be PFICs. Foreign REITs can be PFICs. ETFs here can invest in PFICs – think things like some companies in Canada, foreign private equity names, and even some blockchain businesses outside of the U.S.

According to tax expert Greenback, PFICs can be taxed in 3 different ways: “by excess distribution, market-to-market, or by using a qualified electing fund.” These pooled vehicles can deliver a tax hit annually depending on these tax treatments whether the U.S. investors lives here or abroad.

Cayman Subsidiaries

Another wrinkle to the ETF tax efficiency story is the use of Cayman Subsidiaries to hold futures positions in 40 Act Commodities ETFs – a way 40 Act funds navigate diversification requirements in the commodities space.

It’s not possible to transact in-kind in Cayman accounts, so CILs tend to be the rule. Moreover, gains from Cayman-held futures are typically considered bad income – they get taxed as ordinary income – something commodity ETF investors need to beware of.

REITs, MLPs, or when a ’40 Act ETF owns a ’33 Act ETF

Sometimes a ’40 Act fund can invest directly in a ’33 Act fund. Or an ETF can own a lot of MLPs or REITs, for example. Each of these structures are taxed differently, and combined in a portfolio, they can trigger what’s known as the unrelated business income tax (UBTI).

Faster Capital describes UBTI this way: “UBTI is a tax on income generated by a tax-exempt organization through a trade or business that is unrelated to its core purpose.” According to them, UBTI can be a good thing if it leads to higher returns for a fund, but it can also lead to “unexpected tax liabilities.”

There’s a Reason Tax Experts Exist

You can run into an ETF that owns a PFIC – or is designated a PFIC itself – or you can have a commodity fund that’s not structured as a ’33 Act fund but as a ’40 Act fund, needing a Cayman sub to transact in futures, or you can have a ’40 Act ETF that owns ’33 Act ETF directly – which may trigger yet another wrinkle. Efficiency is a beautiful thing, but that doesn’t mean it isn’t sometimes complicated.

We talk about ETF tax efficiency being the result of unintentional brilliance, but consider this: be intentional about enlisting trading and tax experts to navigate the intricacies of this efficiency. The more you know, the better decisions you can make for your product, for yourself and/or for your client.

Author: Cinthia Murphy