For the last decade, bond investing operated under extraordinary monetary conditions defined by near-zero interest rates, quantitative easing, and a market environment where yield was scarce, and volatility was muted.

With rates pinned down and credit spreads compressed, there was little income to pursue, few risks to hedge, and minimal dispersion to exploit.

Innovation wasn’t held back by a lack of interest—but by a lack of opportunity.

Active managers had few incentives and even fewer levers to pull, and product design often defaulted to plain-vanilla portfolio fillers that simply occupied space in balanced allocations.

Now, with interest rates at their highest levels in over a decade, inflation reshaping market behavior, and equity volatility shaking traditional asset allocation models, asset managers are rediscovering bonds, and the ETF wrapper is proving to be a powerful tool for delivering them.

There’s finally room to get creative again.

Duration, credit quality, curve positioning, and risk hedging are back in play.

2025 marks the start of a fixed income renaissance.

Traditional Bond ETFs Are Still Dominating Flows

It’s worth noting that traditional, short-duration bond ETFs are seeing record-breaking demand in 2025.

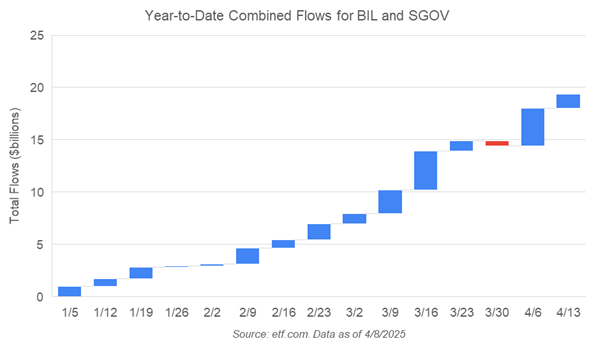

Since the turbulent start to Q1, two of the most prominent Treasury Bill ETFs, BIL and SGOV, have collectively pulled in more than $19 billion in year-to-date inflows, according to data from ETF.com (as of April 8).

In contrast, during Q1 of 2024, the combined net flows for these same funds totaled just $33 million, based on data from ETFdb.com.

This isn’t only a flight to safety; it’s a tactical use of ultra-short duration instruments as precision tools in portfolio construction.

Investors are prioritizing liquidity, yield preservation, and ultra-short duration as foundational building blocks while waiting for longer-term opportunities.

At the same time, global sentiment reinforces this trend.

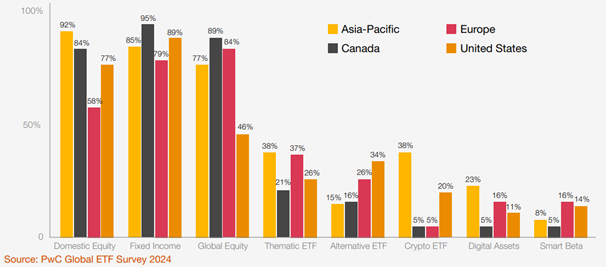

According to PwC’s Global ETF Survey 2024, fixed income is among the most important areas of current and projected ETF growth, with 85% of U.S. respondents and over 77% globally citing it as a strategic focus.

Across all major regions (Asia-Pacific, Europe, Canada, and the US), fixed income stands alongside domestic equity as one of the ETF market’s most resilient and essential pillars.

This Time, It’s Structural

This fixed income renaissance is cyclical AND structural.

The combination of a more informed ETF investor base, advances in fund infrastructure, and regulatory openness has created a foundation for innovation to scale responsibly.

With retail, intermediary, and institutional investors increasingly comfortable with the ETF format across asset classes, managers now have both the confidence and the tools to push beyond traditional strategies.

Areas of Innovation

So far in 2025, the majority of new fixed income ETF launches have been actively managed.

Of the 45 bond ETFs launched this year, 34 are active, and some of them are attracting flows early.

The actively managed Nuveen High Yield Muni Income ETF (NHYM), incepted in January 2025, has nearly doubled its assets under management in just the past month, adding $30 million in net new flows.

Meanwhile, the recent launch of the actively managed PIMCO Multisector Bond Active ETF (PYLD), has seen a dramatic pickup in 2025 alone, bringing in over $1.8 billion year-to-date and more than doubling its AUM in that time.

These early successes are not isolated but part of a broader shift in how fixed income strategies are being conceived and brought to market.

The pipeline of fixed income products reflects this shift in preference and looks nothing like it did five years ago.

New Fixed Income themes include:

- Private Credit ETFs: Once reserved for institutional allocations via LP structures, private credit is now being packaged into ETFs. This democratizes access but also introduces challenges in terms of pricing, liquidity, and transparency.

- Structured Credit & CLOs: Managers are building ETFs around tranches of structured products, capitalizing on the potential for elevated yields and investor demand for income without excessive duration.

- Cash-Plus Strategies: ETFs that sit just beyond money market funds in terms of yield, offering liquidity with a slight increase in credit or interest rate risk.

- Truly Active Mandates: With volatility back, active fixed income managers have room to seek real alpha through tactical allocations, a dynamic that was largely absent for the past decade.

The common thread? Yield is no longer a commodity, and investors are now actively shopping for how yield gets delivered.

Still, as managers push into more complex territory, structural fit matters. Strategies involving less liquid or harder-to-price assets must be carefully stress-tested before entering the ETF format.

Final Thoughts

The fixed income ETF landscape is no longer a passive, low-volatility corner of the market.

Rising rates have unlocked new strategic possibilities, and the ETF wrapper is now flexible and mature enough to deliver them.

For asset managers thinking about entering the space, this is a rare window: investor demand is high, white space exists, and the macro backdrop is aligned with action.

The fixed income renaissance is real, and it’s just beginning.

Thinking about launching a fixed income ETF? Talk to Tidal Financial Group today.