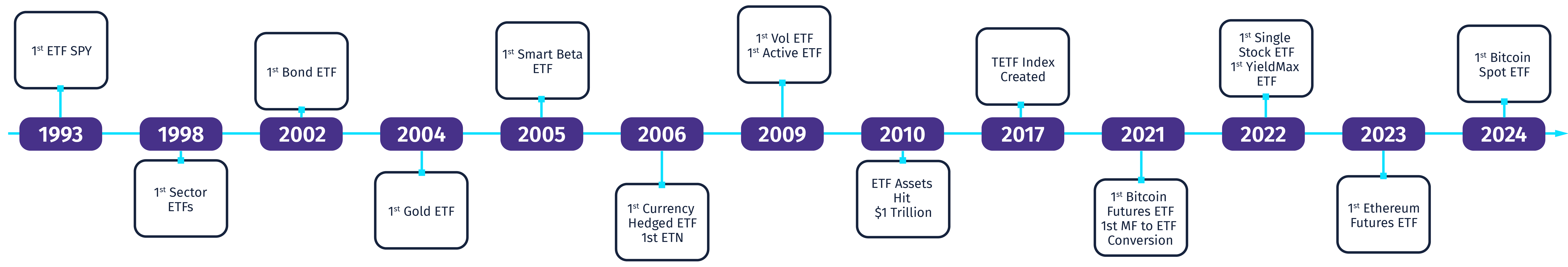

Ever pondered the birth of an ETF? With over 3,000 ETFs in the U.S. market, it’s quite a spectacle. The expanding landscape of ETFs is embracing both new providers and investors, showcasing a rich history of innovation that continues to astonish.

Think about the groundbreaking products that have reshaped market access through an ETF wrapper over the years. From the first-of-a-kind offerings to the latest advancements, each step along this journey has been remarkable.

When we talk about ETFs, it’s like diving into the world of market access – a story where the product is the protagonist delivering and accessing value. We often emphasize that a successful ETF is one that truly addresses an investor’s needs. It all boils down to nailing the product – a straightforward yet crucial measure of success.

Now, let’s delve into how these ETF stories unfold. Every ETF journey begins with an idea.

ETFs Start with Ideas

The birth of an ETF idea can be spontaneous, sparked by “why not” or “what if” conversations. It’s all about finding a better way, a more efficient, transparent, or liquid solution compared to existing investment avenues. Starting with a simple question – “How can we do this better?” – sets the stage for cultivating a new ETF concept.

In recent times, the quest for improved access has driven the emergence of various ETF ideas. From navigating illiquid alternatives to tapping into elusive options markets to converting mutual funds and SMAs, the drive for better access has fueled innovation in the ETF space.

But not all ideas are born spontaneously; some are meticulously crafted with specific objectives in mind. Whether it’s seizing a particular source of return or adapting to market dynamics, intentional ETF ideas are tailored to meet distinct needs.

Take the thematic space, for instance. It’s brimming with timely ideas that capture investors’ attention when market trends align. Think back to the surge in work-from-home ETFs during the peak of the pandemic. Whether it’s non-traditional index products, factor strategies, or values-based approaches, these intentional ideas offer exposure that differs from conventional investment options.

In reality, ETF product development is a fascinating blend of art and science. Success lies in striking the right balance between creativity and strategy. Over the years, we’ve witnessed both triumphs and failures, leading us to distill five simple lessons for aspiring ETF creators:

- New ideas are a dime a dozen, but an a-ha moment is priceless. Everyone comes into this business thinking they have the next billion-dollar idea. If only it were that easy.You would think that coming up with a first-of-a-kind strategy would be a golden ticket, and, in truth, that often does increase your chances of success dramatically. But there have been many firsts that never found their footing because they were either ahead of their time, past their time, or the market just didn’t care.

There’s no roadmap to a lightbulb moment, but you know it when you see it. A lot of the most interesting product innovation and disruption we’ve seen has come from a problem-solving mindset.

Look at the massive use of options in ETF strategies today – you could say it’s one of the new frontiers for product development. Options have often been the realm of professional traders, but creative thinking – brilliant ideation, really – has resulted in smart implementation of options contracts (and more broadly derivatives) in all sorts of new ETF solutions that generate equity income, buffer outcomes and even finds yield in non-yielding assets like gold. Options today, thanks to smart ETF ideas, are the playground of every investor.

Perhaps one lesson here is that an a-ha moment should not go to waste. If you think you’ve come up with something special, explore it, and explore it quickly before someone else thinks of it, too. One of the beauties of this industry is that the ETF ecosystem is collaborative, with partners open to conversation and education. You don’t have to think through an ETF idea alone.

- Direct access almost always beats indirect access.The recent approval of spot bitcoin ETFs is a classic example of the importance of direct access. Futures-based bitcoin ETFs have been around – and successfully so – for more than a year. But investor demand for spot exposure was overwhelming because direct is better.If you are brainstorming a new ETF idea, are you plotting a direct path to a market segment or an asset, or are you lost in a detour?

- First movers are rarely displaced, but if you can’t be first, be the loudest.First-of-a-kind ETFs typically have an upper hand relative to their late-coming competitors. Rarely does a first mover get displaced or demoted from category leader by a clone ETF. We often see that assets that flock to a first mover ETF tend to be sticky, unless, of course, there’s real disruptive innovation within a category.However, the ETF universe is increasingly crowded, so finding white space to be truly original is getting harder and harder.

If originality – or true disruption through innovation – is not in the cards for you, the next best thing is to be a great storyteller. Every ETF is a story to be told, and those who do it well (with simplicity), do it often (repetition is great), and do it loudly (attack all media-channels/formats available to you) tend to find better success than those who do not.

You may not have an original idea, but it may still be a really interesting idea that can stand on its own and be a successful ETF if you are willing to be a face for that product.

- ETFs are exchange-traded. Is your ETF idea tradable?One of the beauties of ETFs is the creation/redemption mechanism that powers up the supply of ETF shares – and keeps share prices in line with the value of the strategy’s underlying holdings. All that trading happens with the help of market makers and authorized participants.More importantly, every ETF has a lead market maker, and that’s not a structural given – that’s earned business because LMMs step in where there’s real opportunity for them. That means a new ETF idea must first pass the LMM muster – can a market maker support it?

One LMM put it this way: Ask yourself, “can the market maker hedge exposure either perfectly, if not imperfectly, in the ETF via some underlying market?”

This is all about risk management. If a LMM cannot hedge their position because, say, the underlying market is not deep enough or not mature enough, or there aren’t vehicles to hedge their risk – in options/derivatives/futures – chances of enlisting the help of an LMM may be difficult for that ETF.

If an idea does not materialize in a tradable exposure for the ETF, go back to drawing board and think some more.

- ETFs are a team sport, so is your team solid?A lot of times ETFs have different players in different teams – advisors, subadvisors, board of directors, capital markets, marketing and distribution, etc., etc. When it comes to making tactical and strategic decisions on the day-to-day management of an ETF – think allocation of resources for operations and distribution – is everyone on the same page?One of the common pitfalls we’ve seen when it comes to partners in this business is mismatched expectations. ETFs are a tough business that can feel more like a cash incinerator than a builder of wealth at first. Hitting a stride that pushes a new fund above breakeven levels and ultimately into the big asset leagues can take time, patience and commitment. It most certainly takes a team playing well together.

Making sure everyone involved in your ETF shares the same conviction in the product that you do is a secret to longevity, and quite honestly, making sure work can be fun, too.