Over the past couple of years, we’ve seen mutual fund-to-ETF conversions gaining traction as a gateway for entering the ETF market.

So, what have we learned? Well, firstly, the future of this trend looks bright. There’s a steady stream of funds making the leap to ETFs, and it’s showing no signs of slowing down. However, let’s not sugarcoat it – the journey hasn’t been a walk in the park for providers. Distribution challenges have proven to be a tough nut to crack.

But here’s the exciting part: between the years 2021 and 2023 alone, close to 40 mutual funds have transformed into ETFs. Big players like Dimensional, Franklin Templeton, Bridgeway, and Goldman Sachs have joined the party, bringing in around $70 billion in assets and there’s more to come.

Why the shift? Well, ETFs just make more sense for many investors. They offer market access, tax management, and a whole lot more. According to Bloomberg Intelligence, ETFs are on track to dominate the fund landscape, expected to surpass 50% of total fund assets in the U.S. by 2027. That’s a significant leap from the current level of around 30%.

What’s driving this shift? Steady inflows and growing interest from traditional mutual fund companies. Investors love the lower expense ratios, transparency, and tax efficiency that ETFs bring to the table.

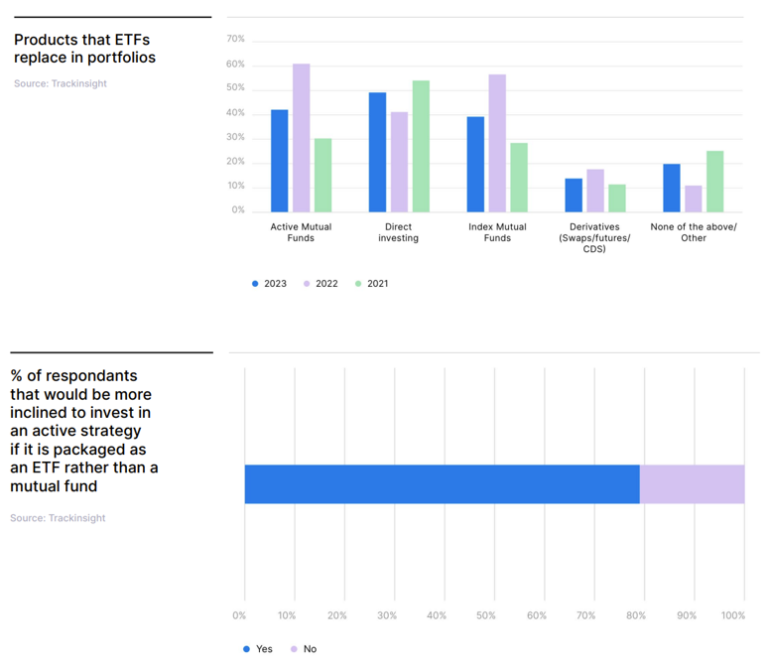

In fact, a recent survey found that a whopping 80% of professional investors in the Americas prefer ETFs over mutual funds for active strategies. And it’s not just talk – more than half have already replaced their active and index mutual funds with ETFs.

“This overwhelming interest in an ETF wrapper is likely due to most ETFs’ lower expense ratios relative to mutual funds. The greater transparency of ETFs and the improved tax efficiency are also likely reasons for the appeal of an ETF wrapper,” the survey said.

In fact, about 2/3 of those surveyed in the Americas, according to the survey, 61% said they’ve already replaced active mutual funds with ETFs, and over half have replaced index mutual funds with ETFs.

Source: TrackInsight Global ETF Survey 2023

A Challenging First Round

Taking stock of the transition from mutual funds to ETFs reveals a landscape that’s been more challenging than initially expected for providers. Since the inaugural conversion in early 2021, there have been nearly 40 conversions orchestrated by 19 different providers. However, the anticipated surge in asset growth following these conversions hasn’t materialized. In fact, most have witnessed stagnant growth or even a decrease in assets.

Several factors influence the reception of a new ETF, including the market environment and fund performance. For a converted ETF to thrive, it must meet certain criteria, what we call the “necessary conditions” for success:

- The product must be well-suited for the market.

- Sufficient capital support is essential.

- The infrastructure needs to be robust.

In many instances, converted strategies lack innovation in terms of accessibility or cost. They fail to address investor needs in a novel way, offering little beyond existing ETF options. Additionally, some of these funds lack distinct features such as high active share, turnover, or complexity that could benefit from the ETF structure. Consequently, they struggle to attract a new investor base.

The success of a conversion also hinges on the original mutual fund’s asset size. A strong asset base or seed capital can significantly impact the ability to attract new investments.

Infrastructure is another critical consideration, particularly in understanding the operational intricacies of ETF trading and distribution. With the ETF market being highly competitive, effective distribution strategies are essential for growth.

ETFs face challenges in platform support compared to mutual funds, as platforms are often incentivized to promote commission-paying products. However, ETFs lack such commissions, which can hinder their distribution and growth potential.

Despite these challenges, some conversions have seen considerable asset growth. Dimensional, for example, experienced substantial inflows exceeding $10 billion following the conversion of its initial lineup of seven Mutual Funds to ETFs. Their success can be attributed to a deep understanding of their client base and offering competitive, sensible products with lower fees and greater diversification.

Similarly, firms like Neuberger Berman have achieved significant growth, with their converted commodity strategy witnessing a 35% increase since conversion.

While the journey from MFs to ETFs has been arduous, it reaffirms the belief in ETFs as the future of investment. ETFs offer solutions in terms of accessibility, cost, and tax efficiency, evident in investors’ preference for ETFs over mutual funds.

Ultimately, the transition underscores the reality of the industry: while the entry barrier may be low, achieving success in the ETF market requires meeting high standards. MF-to-ETF conversions serve as a testament to this notion.