Investors first came to the ETF structure to access market beta in a transparent and liquid vehicle. During the first decade the large issuers like iShares, Vanguard and State Street sliced and diced market caps, geographies and sectors into concise passive ETFs. Then came other asset classes like fixed income and commodities. During the last decade, a shift toward “better” passive, often called “Smart Beta” grabbed investor attention from issuers like Invesco, First Trust, and Van Eck. This then led to the rise in active ETFs with contributions from Amplify, ARK and PIMCO.

In recent years, the ETF landscape has undergone significant shift toward complex active strategies with a focus on income. This has been primarily driven by two factors:

- Shifting investor demands: In response to high interest rates, investors have been seeking alternative investment strategies that can provide attractive yields and mitigate risk at the same time.

- Landmark changes to ETF regulations: The ETF Rule and The Derivatives Rule have unlocked new avenues for innovation in the ETF industry, allowing providers to design and offer more advanced investment strategies. This has led to the development of more complex and sophisticated ETFs, catering to a broader range of investor needs and preferences.

This article explores a major beneficiary of the ETF industry’s evolution: high option income strategies.

History of Option Income

Option income ETFs have been around for over a decade but have only recently gained significant momentum and investor attention.

The first wave in the development of income strategies was limited to Closed-End Funds (CEFs), like the Nuveen S&P 500 Buy-Write Income (BXMX), that was launched in 2004. Despite being exchange-traded, CEFs fell short of modern ETFs in several key areas. Specifically, their lack of intraday creation and redemption capabilities significantly impairs performance, leading to reduced liquidity, tax inefficiencies, and wider bid-ask spreads.

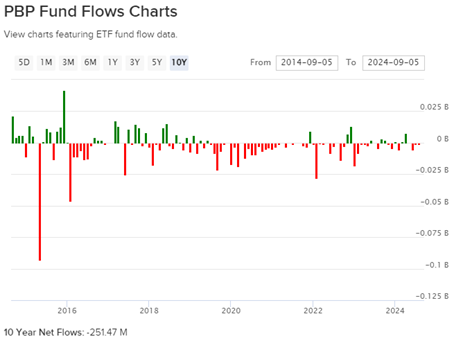

The first ETF to ever explore this route was launched in 2007, the Invesco S&P 500 Buy/Write ETF (PBP). PBP utilized a straightforward buy/write strategy to generate income by selling call options. However, despite its attractive yield, PBP’s passive approach limited its potential, resulting in -$250m of net flows over a 10-year period, highlighting the need for a more dynamic structure to fully capitalize on the option income opportunity.

Here is the link to PBP for website and standardized performance

The next step in option income ETFs involved fund-of-funds (FOFs), which are essentially diversified ETF portfolios offering a single point of access to a collection of underlying funds. These FOFs invest in CEFs mentioned earlier, like BXMX, offering investors exposure to a portfolio of income CEFs. Examples of such ETFs include:

- Invesco CEF Income Composite ETF (PCEF), launched in 2010, with an expense ratio of 3.08%

- Amplify High Income ETF (YYY), launched in 2013, with an expense ratio of 4.60%

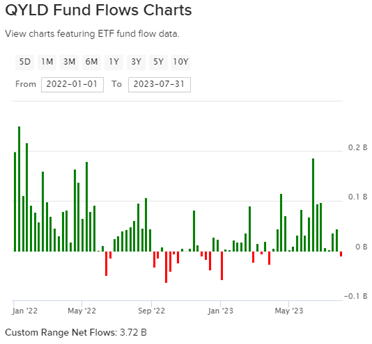

If you notice, you can see that these FOFs come with a hefty expense ratio, well above the average ETF expense ratio. This led to the next iteration of option income ETFs emerging in 2013 with the launch of Global X’s suite of buy-write ETFs, led by the flagship QYLD, offering a more complex strategy at a lower expense ratio. AUM flow had struggled to find its footing until recently, when these ETFs finally started to gain traction due to evolving investor demands.

Here is the link to PCEF for website and standardized performance

Here is the link to YYY for website and standardized performance

The First Catalyst:

In March 2022, the Federal Reserve implemented an unprecedented tightening cycle, increasing the federal funds rate from 0.25% to 5.50% within a 16-month period, marking the most rapid inflationary tightening in over four decades. This significant rise in interest rates prompted investors to seek higher-yielding investment opportunities while choosing to maintain market exposure. Consequently, investor demand shifted towards ETFs offering elevated yields, such as the Global X Nasdaq 100 Covered Call ETF (QYLD), which experienced substantial growth, attracting approximately $3.7 billion in AUM from January 2022 to July 2023.

The Second Catalyst:

Two key regulatory changes have contributed to the evolution of Option Income ETFs forever:

- The ETF Rule: The ETF Rule, officially known as Rule 6c-11 under the Investment Company Act of 1940, was adopted by the SEC in September 2019. The rule was implemented to standardize the regulatory framework for most ETFs and creating parity with mutual funds. This rule enabled ETFs to operate on an equal footing with mutual funds, permitting them to engage in all activities allowed for mutual funds. By simplifying the regulatory process, the ETF Rule has encouraged more competition and innovation in the ETF space, leading to a broader range of products, including actively managed ETFs, thematic ETFs, and Option Income ETFs. This, in turn, directly led to the success of active option income ETF JEPI:

- The JPMorgan Equity Premium Income ETF (JEPI) has been one of the fastest-growing ETFs in recent history, amassing approximately $34 billion in AUM in just three years, making it the world’s largest active ETF. JEPI aims to generate high monthly income through a combination of stock dividends and options premium.

Here is the link to JEPI for website and standardized performance

- The Derivatives Rule: The Derivatives Rule, officially known as Rule 18f-4 under the Investment Company Act of 1940, was adopted by the SEC in October 2020 and became effective on August 19, 2022. This rule allowed for the use of single-security ETFs, enabling funds to offer products that harvest the volatility of a single stock. Additionally, the rule permitted the use of leveraged ETFs, which potentially can substantially enhance returns. Notable examples of option income ETFs that have successfully applied this rule include:

- YieldMax TSLA Option Income Strategy ETF (TSLY) launched in November 2022 and was the first ETF to implement covered-call strategies on a single stock. TSLY received ~ $1billion in net flows over its first year of inception.

- Defiance Nasdaq 100 Enhanced Options Income ETF (QQQY) was the first put-write ETF using daily options to seek enhanced yield for investors.

- REX FANG & Innovation Equity Premium Income ETF (FEPI) is an innovative option income ETF that combines FANG+ tech stock exposure and income from a covered-call ETF.

Here is the link to TSLY for website and standardized performance

Here is the link to QQQY for website and standardized performance

Here is the link to FEPI for website and standardized performance

Conclusion

ETF innovation is accelerating, driven by new regulations and investor demand for advanced strategies. At Tidal, we specialize in complex products and are here to help you launch, operate, and grow your ETFs.

IMPORTANT INFORMATION FOR TSLY:

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, which my be obtained by clicking here. Please read the prospectuses carefully before you invest.

Investments involve risk. Principal loss is possible. Shareholders of the Fund are not entitled to dividends paid out by TSLA.

THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH TESLA, INC.

Due to the Fund’s investment strategy, the Fund’s investment exposure is concentrated in the same industry as that assigned to TSLA. As of the date of the Prospectus, TSLA is assigned to the auto manufacturing industry. As with any investment, there is a risk that you could lose all or a portion of your investment in the Fund. Some or all of these risks may adversely affect the Fund’s net asset value (“NAV”) per share, trading price, yield, total return, and/or ability to meet its objective.

Indirect Investment in TSLA Risk. Tesla, Inc. is not affiliated with the Trust, the Fund, the Adviser, the Sub-Adviser, or their respective affiliates and is not involved with this offering in any way and has no obligation to consider your Shares in taking any corporate actions that might affect the value of Shares. Investors in the Fund will not have voting rights and will not be able to influence management of Tesla, Inc. but will be exposed to the performance of TSLA (the underlying stock). Investors in the Fund will not have rights to receive dividends or other distributions or any other rights with respect to the underlying stock but will be subject to declines in the performance of the underlying stock. TSLA Trading Risk. The trading price of TSLA may be highly volatile and could continue to be subject to wide fluctuations in response to various factors.

Electric Vehicles Risk. The future growth and success of Tesla, Inc. are dependent upon consumers’ demand for electric vehicles, and specifically, its vehicles in an automotive industry that is generally competitive, cyclical and volatile. If the market for electric vehicles in general and Tesla, Inc. vehicles in particular does not develop as Tesla, Inc. expects, develops more slowly than it expects, or if demand for its vehicles decreases in its markets or its vehicles compete with each other, the business, prospects, financial condition and operating results of Tesla, Inc. may be harmed. Tesla, Inc. is still at an earlier stage of development and have limited resources and production relative to established competitors that offer internal combustion engine vehicles. In addition, electric vehicles still comprise a small percentage of overall vehicle sales.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the option contract and economic events. For the Fund in particular, the value of the options contracts in which it invests are substantially influenced by the value of TSLA.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

U.S. Government and U.S. Agency Obligations Risk. The Fund may invest in securities issued by the U.S. government or its agencies or instrumentalities. U.S. Government obligations include securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies or instrumentalities, such as the U.S. Treasury.

Launch & Structure Partner: Tidal ETF Services

The Funds are distributed by Foreside Fund Services, LLC. Foreside is not affiliated with YieldMax or Tidal.

IMPORTANT INFORMATION FOR QQQY:

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, which my be obtained by clicking here. Please read the prospectuses carefully before you invest.

Investing involves risk. Principal loss is possible. As an ETF, the funds may trade at a premium or discount to NAV. Shares of any ETF are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. A portfolio concentrated in a single industry or country, may be subject to a higher degree of risk.

There is no guarantee that the Fund’s investment strategy will be properly implemented, and an investor may lose some or all of its investment. None of the Fund, the Trust, the Adviser, the Sub-Adviser, or their respective affiliates makes any representation to you as to the performance of the Index. THE FUND, TRUST, ADVISER, AND SUB-ADVISER ARE NOT AFFILIATED WITH, NOR ENDORSED BY, THE INDEX.

Indirect Investment Risk. The Index is not affiliated with the Trust, the Fund, the Adviser, the Sub-Adviser, or their respective affiliates and is not involved with this offering in any way. Investors in the Fund will not have the right to receive dividends or other distributions or any other rights with respect to the companies that comprise the Index but will be subject to declines in the performance of the Index.

Index Trading Risk. The trading price of the Index may be highly volatile and could continue to be subject to wide fluctuations in response to various factors. The stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of companies.

The Nasdaq 100 Index Risks: The Index’s major risks stem from its high concentration in the technology sector and significant exposure to high-growth, high valuation companies. A downturn in the tech industry, whether from regulatory changes, shifts in technology, or competitive pressures, can greatly impact the index. It’s also vulnerable to geopolitical risks due to many constituent companies having substantial international operations. Since many of these tech companies often trade at high valuations, a shift in investor sentiment could lead to significant price declines.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with underlying investments, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Price Participation Risk. The Fund employs an investment strategy that includes the sale of in-the-money put option contracts, which limits the degree to which the Fund will participate in increases in value experienced by the Index over the Call Period (typically, one day, but may range up to one week). This means that if the Index experiences an increase in value above the strike price of the sold put options during a Call Period, the Fund will likely not experience that increase to the same extent and may significantly underperform the Index over the Call Period. Additionally, because the Fund is limited in the degree to which it will participate in increases in value experienced by the Index over each Call Period, but has full exposure to any decreases in value experienced by the Index over the Call Period, the NAV of the Fund may decrease over any given time period.

Distribution Risk. As part of the Fund’s investment objective, the Fund seeks to provide current weekly income. There is no assurance that the Fund will make a distribution in any given month. If the Fund does make distributions, the amounts of such distributions will likely vary greatly from one distribution to the next.

High Portfolio Turnover Risk. The Fund may actively and frequently trade all or a significant portion of the Fund’s holdings. A high portfolio turnover rate increases transaction costs, which may increase the Fund’s expenses.

Liquidity Risk. Some securities held by the Fund, including options contracts, may be difficult to sell or be illiquid, particularly during times of market turmoil. This risk is greater for the Fund as it will hold options contracts on a single security, and not a broader range of options contracts.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

QQQY is distributed by Foreside Fund Services, LLC.