Focusing on specific business characteristics to boost index performance is a common strategy in most smart beta and non-traditional investing approaches.

However, in the past few years, we have seen a trend towards exclusion-focused ETFs, which aim for higher risk and reward by removing certain companies from an index. Here, we discovered three common trends:

- Environmental, Social, and Governance (ESG)1 exclusions

- Religious exclusions

- State Owned Enterprise (SOE) Exclusions

Below, we explore these trends, and the impact exclusions have had on performance.

Carbon-Cut

ESG ETFs are a prime example of how exclusion can shape investment strategies. With over 60 equity funds and more than $50 billion in assets, navigating the ESG space can be complex. These funds typically use negative screens to exclude companies deemed “bad actors.”

On the flip side, they often use positive screens to overweight companies with strong ESG performance, balancing exclusion with the goal of promoting better corporate practices and sustainability.

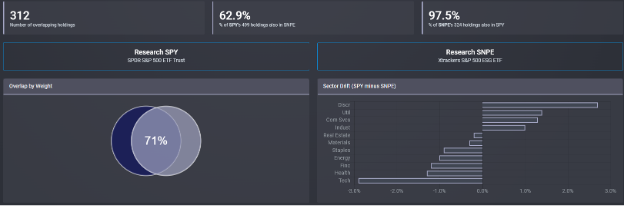

We highlighted a clear example of exclusion with the Xtrackers S&P 500 ESG ETF (SNPE), which starts with the traditional S&P 500 but filters out companies with low ESG scores. This exclusionary process removes roughly 200 companies, such as Meta and Johnson and Johnson.

Despite these exclusions, the ETF maintains sector exposure similar to the broader S&P 500 index.

While returns are nearly identical year-do-date, SNPE has outperformed SPY over the 5-year period, returning 105.56% compared to SPY’s 92.67%, as of Oct 21st, 2024.

Here is the link to SNPE for website and standardized performance

Here is the link to SPY for website and standardized performance

Divine Intervention

Religious exclusion ETFs offer a compelling comparison to broader ESG strategies, focusing on value-driven investing. These funds reflect specific religious principles, with Christian and Islamic values most prominent. Two standout funds include:

- SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS), which invests in companies that adhere to Sharia law, avoiding industries like high leverage, credit cards, pork products and more.

- Global X S&P 500 Catholic Values ETF (CATH), which invests in companies aligned with the U.S. Conference of Catholic Bishops’ values, specifically excluding those involved in activities like stem cell research, biological weapons, contraception, and more.

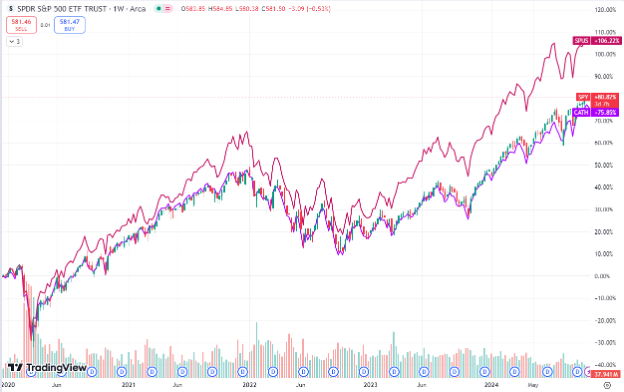

These two ETFs start out with the traditional S&P 500 but then filters out companies based on their religious values. SPUS excludes over 250 companies, involving major financial firms like Berkshire Hathaway and JP Morgan, while CATH filters out around 60 companies, such as Amazon and Eli Lilly.

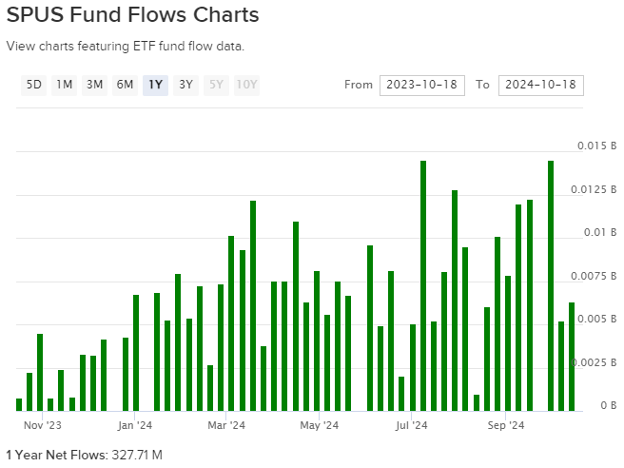

Over the past year, SPUS has exploded in inflows, attracting approximately $327million in AUM from October 2023 to October 2024.

SPUS, since its inception on December 17th, 2019, has outpaced SPY, delivering an impressive 106.22% return compared to SPY’s 80.82%, as of October 21st, 2024.

Here is the link to SPUS for website and standardized performance

Here is the link to CATH for website and standardized performance

Bureaucracy Booted

One of the more straightforward exclusion strategies in the ETF world is avoiding companies with significant government ownership, often referred to as State-Owned Enterprises (SOEs). This exclusion is based on the premise that government interests often diverge from those of shareholders, potentially leading to inefficiencies or conflicts of interest.

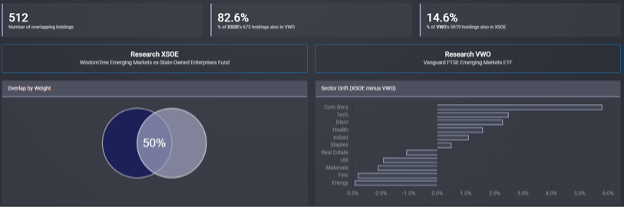

WisdomTree has been a key player in this space with its WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE), which filters out companies from Emerging Markets with more than 20% state ownership.

When comparing XSOE to the benchmark Vanguard FTSE Emerging Markets ETF (VWO), XSOE holds significantly fewer stocks—about 5,000 less—which leads to roughly a 50% overlap by weight.

Although emerging markets have generally underperformed in recent years, XSOE has managed to edge out VWO over the past 5 years, delivering a return of 14.36% compared to VWO’s 12.90%, as of October 21st, 2024.

Here is the link to XSOE for website and standardized performance

Here is the link to VWO for website and standardized performance

More with Less

As ETF investing evolves, new trends and innovations are rapidly reshaping the market. Although the idea of using exclusions to enhance returns isn’t new, its applications are becoming more varied and can serve as strong drivers of performance.