Unlocking ETFs With Derivatives

In recent years, the Exchange Traded Fund (ETF) world has witnessed a massive shift of interest. At the heart of this shift lies the explosive growth of active ETFs, a trend that shows no signs of slowing down.

With active ETFs representing 20% of industry revenue, 25% of total ETF flows in 2024 and a staggering $900 billion in assets under management (AUM), the rise of active ETFs signals more than just a fad, it’s a paradigm shift.

From tailored income strategies to innovative risk management tools, active ETFs are rewriting the playbook for modern investment portfolios. But what’s fueling this growth? And where is the innovation leading us next?

Where are Active ETFs Right Now

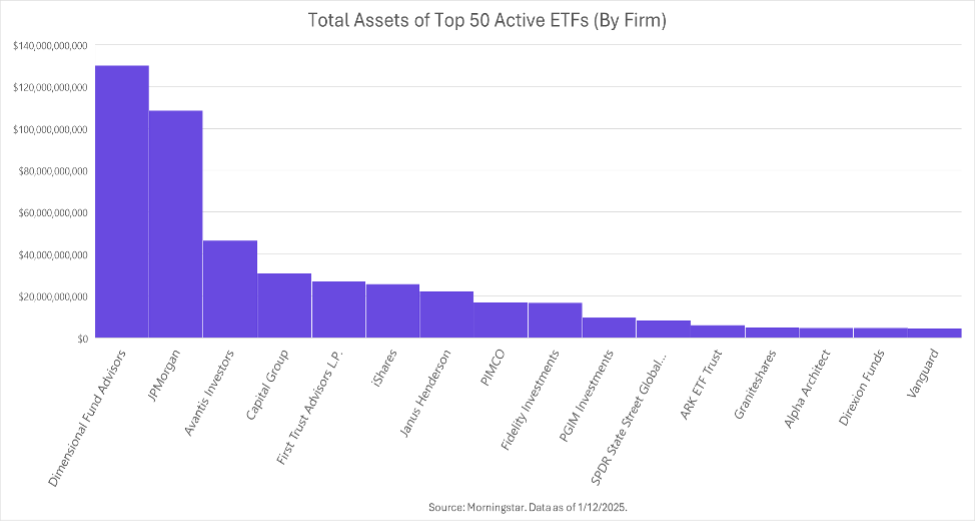

Leading the charge are traditional active players like Dimensional, with 41 listed active ETFs, and Avantis, with 28. Together, these two firms account for 24% of total active ETF AUM.

Their success lies in systematic, factor-based strategies that combine index-like efficiency with targeted tilts toward size, value, and quality.

ETFs like Dimensional U.S. Core Equity 2 ETF (DFAC) and Avantis U.S. Small Cap Value ETF (AVUV), represent this to a tee. DFAC derives its holdings from the Russel 3000 Index, but using its active manner adds an emphasis on companies they believe will provide higher expected returns. Similarly, AVUV derives its holdings from the Russell 2000 Value Index, but uses its active capability to make swift investment decisions based on current valuations.

These strategies attract investors aiming for higher returns without the costs and risks associated with traditional stock-picking. While substantial inflows have gone into these systematic, semi-passive active funds, another segment of the ETF industry is surging like a rising tide, fully embracing the true essence of active management: Derivative-based ETFs.

The Derivative ETF

As I highlighted in a previous paper, Rules 6c-11 and 18f-4 of the Investment Company Act of 1940 (the “ETF Rule” and “Derivatives Rule,” respectively) have empowered creative asset managers to transform their ambitious ideas into reality.

The ETF Rule enabled ETFs to operate on equal footing with mutual funds by standardizing regulations and simplifying processes. The Derivatives Rule enabled single-security ETFs, allowing funds to harness the volatility of individual stocks, and also permitted leveraged ETFs, which can significantly amplify returns.

Beneficial regulations like these have allowed the ETF wrapper to utilize financial instruments like options, futures, or swaps to achieve specific investment objectives, such as hedging risk, leveraging returns, or generating income from options. This has opened the floodgates for Option-Based Income ETFs, Single Stock Leveraged + Inversed ETFs, Buffer ETFs, Defined Outcome ETFs and many more.

Massive Growth

Over the past two years, the derivatives-based ETF market has seen a hockey stick chart in growth.

In 2023, the derivatives-based ETF market accounted for $46 billion out of the $349 billion in active AUM. Fast forward to January 12th, 2025, and that figure has skyrocketed to $168 billion, representing approximately 18% of the $900 billion in active AUM. This remarkable growth reflects an extraordinary, annualized growth rate of 85% since 2023. Notably, in 2024 alone, 570 of the 723 ETFs launched, roughly 78%, were actively managed, with nearly 50% of these active launches incorporating derivative-based strategies. This surge underscores the growing investor appetite for innovative and flexible strategies that cater to many financial objectives.

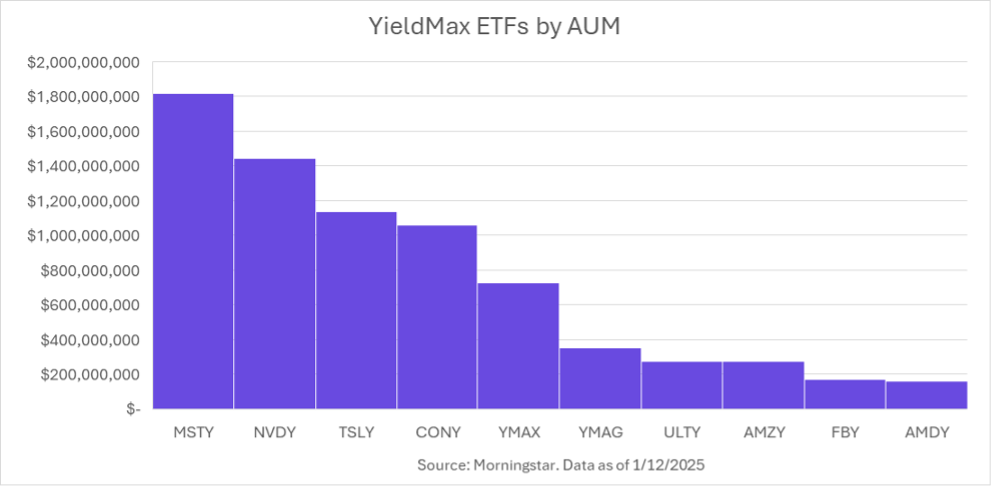

A prime example of this innovation is the YieldMax™ family of ETFs, which has grown its AUM eightfold over the past year, from ~$1 billion to over $8.5 billion as of January 12, 2025. Among its standout products is the YieldMax™ MSTR Option Income Strategy ETF (MSTY), the largest single-stock options-based income ETF. MSTY seeks to generate monthly income by writing call options on MicroStrategy stock, with the goal of delivering attractive yields while offering capped participation in MSTR’s price gains. Since its inception in February 2024, MSTY has thrived, amassing $1.8 billion in assets by capitalizing on the Bitcoin wave.

The fund (MSTY) does not invest directly in MSTR. Investing in the fund involves a high degree of risk.

Single Issuer Risk. Issuer-specific attributes may cause an investment in the fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the fund, which focuses on an individual security MSTR, may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of a traditional pooled investment or the market as a whole.

The fund strategy will cap its potential gains if MSTR shares increase in value. The fund’s strategy is subject to all potential losses if MSTR shares decrease in value, which may not be offset by income received by the fund. The fund may not be suitable for all investors.

Shareholders of the fund are not entitled to any dividends paid by MSTR.

MSTY does not invest in Bitcoin.

Where Innovation Is Headed

Now, fund managers are asking, “What else can we do?” The short answer? Almost anything. If it’s been done in a structured product at a bank, it’s likely being considered for an ETF wrapper. According to Gavin Filmore, Chief Revenue Officer at Tidal, “We’re only at the tip of the iceberg. Derivative-based ETFs are revolutionizing the game, and this trend is just getting started. The ETF wrapper is unlocking strategies once reserved for Wall Street’s elite and making them accessible to everyone.”

But innovation doesn’t come without challenges. While the Derivatives Rule has removed some barriers, others remain. For one, the Derivatives Rule’s Value-at-Risk (VAR) requirements imposes precise limits on a fund’s derivatives risk-taking, demanding careful navigation by asset managers. Hatim Banaja, SVP of Operations at Tidal, notes, “The VAR requirements serve as both a safeguard and a framework, promoting responsible innovation within transparent risk guidelines, which requires deep understanding and knowledge to operate effectively and in compliance with the requirements’ parameters.”

Liquidity is another key consideration. As Ryan Bader, VP of Capital Markets at Tidal, points out, “The success of these products will depend on their ability to balance complexity with the tradability of the underlying basket. The implied liquidity of an ETF is the lifeblood to having a successful product, and it’s no different here.”

A Bright Future

Innovation can only go so far without demand. Fortunately, the appetite for complex active ETFs is high. Thanks to recent favorable regulations, fund managers have a broader canvas to paint on, allowing innovation to be more possible than ever. Whether it’s income generation, downside protection, or capital appreciation, these products are designed to resonate with a wide range of needs.

The future of active ETFs is bright, but navigating this complex landscape requires knowledge and experience. That’s where partners like Tidal Financial Group come in. With a proven track record of helping clients bring innovative products to market, Tidal is well-positioned to guide fund managers through the intricacies of product development, compliance, and distribution.

Disclaimer

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus. For a prospectus or summary prospectus with this and other information about the fund, please visit our website at https://www.yieldmaxetfs.com/msty/. Please read the prospectus carefully before you invest.

Investment involves risk. Principal loss is possible.

Derivatives Risk. Derivatives are financial instruments that derive value from the underlying reference asset or assets, such as stocks, bonds, or funds (including ETFs), interest rates or indexes. The Fund’s investments and derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other ordinary investments, including risk related to the market, imperfect correlation with the underlying investment or the Fund’s other portfolio holdings, higher price volatility, lack of availability, counterparty risk, liquidity, valuation and legal restrictions.

Options Contracts. The use of options contracts involves investment strategies and risks different from those associated with ordinary portfolio securities transactions. The prices of options are volatile and are influenced by, among other things, actual and anticipated changes in the value of the underlying instrument, including the anticipated volatility, which are affected by fiscal and monetary policies and by national and international political, changes in the actual or implied volatility or the reference asset, the time remaining until the expiration of the contract option and economic events.

Single Issuer Risk. Issuer-specific attributes may cause an investment in the Fund to be more volatile than a traditional pooled investment which diversifies risk or the market generally. The value of the Fund, which focuses on the individual security (MSTR), may be more volatile than a traditional pooled investment or the market as a whole and may perform differently from the value of the traditional pooled investment or the market as a whole.

The YieldMax funds are distributed by Foreside Fund Services, LLC. Foreside Fund Services, LLC is not affiliated with YieldMax.