Launching an ETF is a significant step, but the true measure of success lies in its sustained viability. We have explored the compelling rationale behind launching an ETF, from operational benefits and expanded product offerings to tax advantages and broader market access. These benefits are advantageous for both investors and product providers alike.

However, the journey doesn’t end with the launch. Ensuring its long-term success presents the true challenge. The success of an ETF, measured by its asset growth and market longevity, depends on several critical factors:

- The product must be well-suited to the market.

- Adequate capital support is essential.

- Robust infrastructure must be in place.

While meeting these conditions doesn’t guarantee success, it significantly enhances the likelihood that your ETF will stand out in a crowded marketplace and attract a dedicated investor base over time.

ETF Graveyard

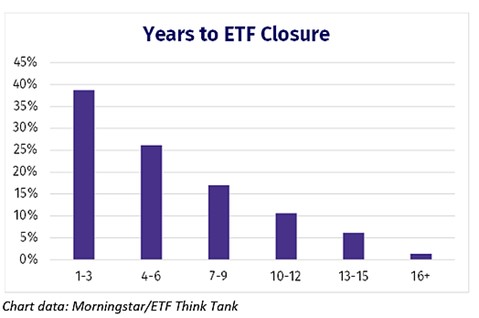

The first couple of years are the most challenging for any ETF because without a lot of assets nor an established live track record, many ETFs struggle to find their way into the advisory channel where the bulk of investable assets sit.

Data shows that most ETFs that end up closing, do so within the first two years. Getting an ETF to survive that initial phase is the first step toward success.

Necessary Conditions for ETF Success

- The product has to be right.To succeed, an ETF must address an investor’s need. This can involve offering new market access, better access to an existing asset class or segment, or lower fees. Innovation is crucial for an ETF to succeed.

While the early days of ETFs offered plenty of opportunities, today’s market is more saturated. The low-cost traditional beta segment is nearly exhausted, while smart beta and thematic ETFs have proliferated. Coming up with a groundbreaking idea is challenging but achievable.

How Can a Product Be Right?

One viable approach is to start with an existing, successful strategy such as an SMA, mutual fund, hedge fun, and convert it to an ETF. The advantages of ETFs—transparency, liquidity, low cost, and tax efficiency—offer what we call structural alpha to investors, solving a key investor problem.

Another way is to offer either impressive performance or competitive pricing.

The first, performance, is harder to control because markets are impossible to predict. But if you bring to market a product that delivers strong performance – whether that’s by closely tracking an index or outperforming a benchmark – chances are assets will follow. Asset flows combined with market gains translate into asset growth. And assets point to longevity.

The second, price, is an easier equation to solve. The guideposts of what works are already in place. Competitive pricing is a simpler aspect to control. In purely beta space, the cost is extremely low.

- The capital support needs to be there.It takes money to launch an ETF, and it takes money to keep an ETF running. In some ways success starts with survival, so a provider needs to be able to support the operations of a fund until it finds critical mass.

Estimates vary depending on the type of strategy and services needed, but a good rule of thumb is that it can cost anywhere from $70,000 to $120,000 to launch an ETF, and an estimated $200,000 to $250,000 a year to keep that fund running.

In the absence of any asset growth in the fund, these operating costs would have to be out of pocket for the ETF provider, so securing capital is important. Part of that capital need is the initial seed. The size of the ETF seed at launch, or very early on, is not in itself a necessary condition, but it’s a game changer in the race to survival.

Yes, an ETF can come to market with $1 million-$2 million in seed capital, but most advisors and many investors will not even look at an ETF until the fund has at least $10 million in assets, and in many cases, $25 million minimum. The bigger the seed, the better the chances a new ETF finds traction right out of the gate, and kick starts that asset growth journey.

Operating costs and seed are critical to an ETF surviving and thriving, which makes capital support a key component of any ETF’s success story.

- The infrastructure must be in placeManaging an ETF involves a lot of intricate components. Here’s a breakdown of the essential operational infrastructure required:

- Trust and Board of Directors: Governance and oversight.

- Legal/Compliance Team: Handles regulatory paperwork and ensures the ETF’s activities comply with current regulations.

- Trading Desk/Team: Manages daily share trading, creation, and redemptions, and interacts with authorized participants and market makers.

- Distribution Team: Focuses on marketing and sales, serving as the public face of the fund.

While some companies have these resources in-house, many ETF issuers leverage partnerships and service agreements within the industry to access these necessary services economically.

The advantage is that many of these services can be outsourced. However, the long-term success of an ETF hinges on excellence in every aspect of this ecosystem, from daily operations to trading, marketing, and distribution.

- Game Changers

Achieving success in the ETF market is never a given, but certain actions can significantly boost your chances when combined with the right conditions.

One crucial factor is seed capital. As previously mentioned, having robust seed capital can set you up for success, especially if you innovate in areas like access and fees.

Other potential game changers include:

- Thoughtful Mutual Fund Conversions: As highlighted earlier, converting mutual funds thoughtfully can be transformative.

- Strategic Partnerships: Collaborating with influencers or leveraging a strong distribution network can greatly enhance your market reach.

- Leveraging Existing Assets: Utilizing an existing captive asset base, essentially bringing your own assets, can provide a significant advantage.

Additionally, there are two less obvious yet impactful elements to consider:

- Clever Tickers: While a ticker symbol alone isn’t a game changer, a creative and memorable ticker can make your ETF stand out. A good ticker symbol is catchy, descriptive, and unforgettable, making it an effective marketing tool.

- Luck: Sometimes success hinges on being in the right place at the right time. Whether it’s launching a product in a favorable market environment or being the first to market with a new trend, timing can play a critical role. However, luck is unpredictable and beyond anyone’s control. The best you can do is hope it’s on your side.

Aligning all these necessary conditions and game changers is challenging. If it were easy, everyone would be launching successful ETFs. However, with careful planning, the right partners and a bit of luck, success is within reach.