The year 2024 has been nothing short of extraordinary, particularly for the Exchange-Traded Fund (ETF) industry. This year has shattered records across the board, from new listings to net inflows and total assets under management (AUM).

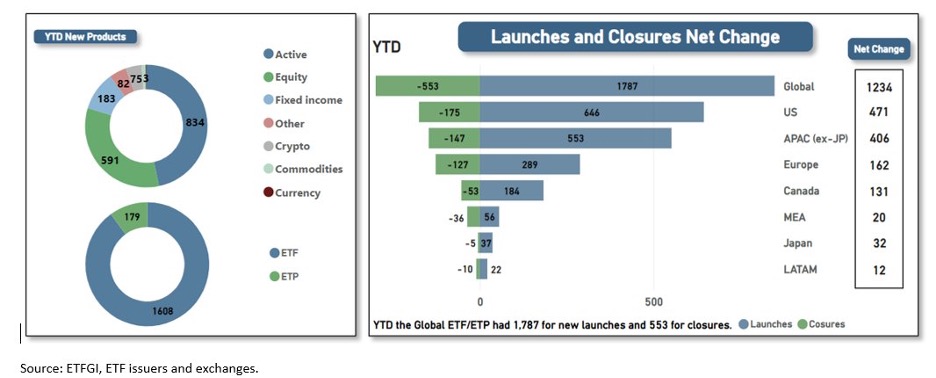

As of November 30th, the ETF industry globally has launched a record 1,787 new ETFs. The growth in assets has been equally remarkable. Global ETF assets have surged by approximately 32% year-to-date, reaching a staggering $15 trillion in total value. In terms of inflows, Worldwide ETF inflows have surpassed $1.67 trillion this year, with the U.S. ETF market alone contributing a record-breaking $1 trillion.

Even more astonishing is the performance of S&P 500 ETFs, particularly VOO and IVV, which together have attracted an incredible ~$200 billion in inflows this year. Vanguard’s VOO brought in $117 billion, while BlackRock’s IVV garnered $87 billion, both shattering previous annual inflow records for a single ETF.

This surge in activity reflects the growing demand from investors eager to incorporate ETFs into their portfolios, a testament to their versatility and appeal to all types of investors.

A Landmark Year for Institutional Bitcoin Adoption

The year 2024 will also be remembered as a pivotal moment for institutional adoption of Bitcoin, led by the asset management giant BlackRock. After years of attempts to launch a spot Bitcoin ETF, tracing back to the Winklevoss twins’ efforts in 2013, the long-awaited approval finally came on January 10, 2024. This milestone saw the simultaneous launch of 9 spot Bitcoin ETFs, marking a transformative event for the cryptocurrency market.

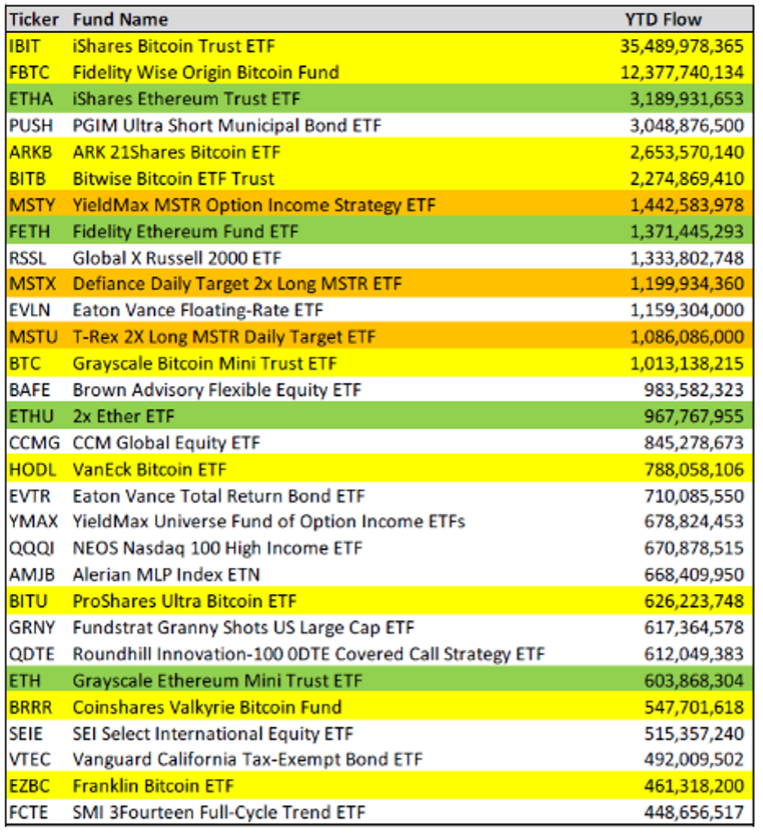

Crypto-related ETFs dominated the industry’s top launches this year. Among the top 30 ETFs introduced in 2024, over half were crypto-focused, including 9 Bitcoin ETFs, 4 Ethereum ETFs, and 3 MicroStrategy ETFs.

The standout performer, however, has been BlackRock’s Bitcoin ETF, IBIT. By November 2024, IBIT had reached $40 billion in assets under management (AUM), achieving this feat in a record-breaking 211 days. This rapid growth outpaced the previous record set by BlackRock’s IEMG, which took 1,253 days to hit a similar milestone. As of December 19, 2024, IBIT’s AUM has surged to $53 billion, solidifying its position as a groundbreaking success in the ETF and crypto markets.

Single Stock Strategies

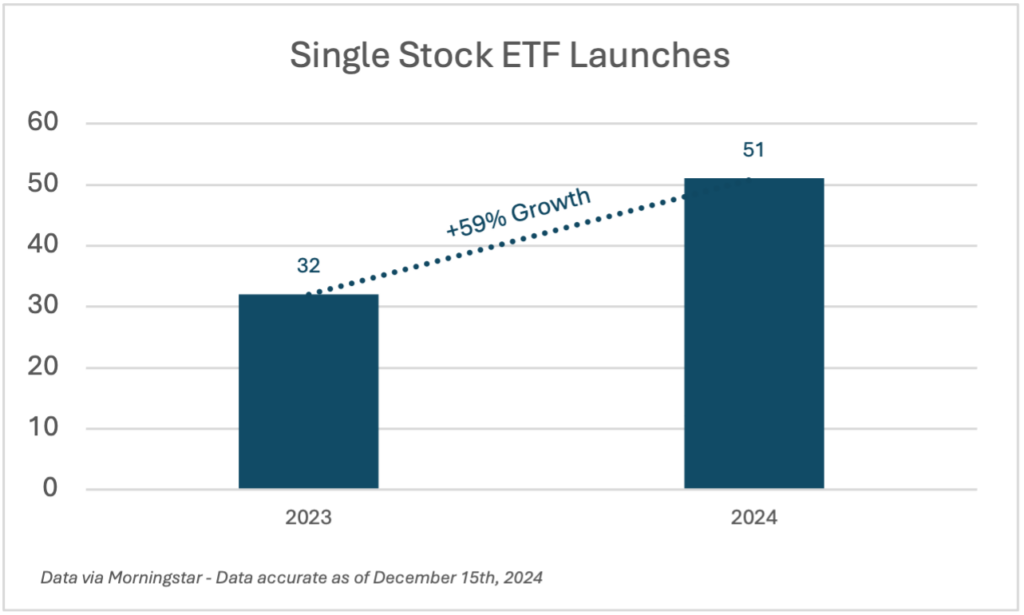

Single stock strategies have captured significant attention this year, driven by innovative approaches ranging from leveraged and inverse strategies to option income-focused ETFs. In 2024, the industry saw a 59% surge in new single stock ETF launches, rising from 32 in 2023 to 51 this year. Single stock strategies accounted for approximately 8% of all ETFs introduced in 2024, highlighting their growing prominence.

This rapid increase is fueled by rising investor appetite for these specialized strategies. Leveraged single stock ETFs, in particular, have shown remarkable growth. Assets in 2x single stock ETFs have skyrocketed from $1 billion at the start of the year to $20 billion by year-end, a staggering 60-fold increase, far outpacing the overall growth rate of the ETF market.

Active ETFs

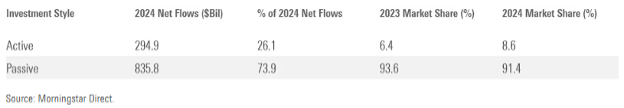

Active ETFs have experienced a remarkable surge in interest throughout 2024. As of December 15, approximately 78% of all U.S. ETF launches have been actively managed, underscoring a significant shift in investor preferences. These strategies have attracted an impressive $295 billion in new investments, doubling the inflows recorded in the previous year.

The appeal of actively managed ETFs is further highlighted by their strong performance in capturing market share. In 2024, active strategies captured 26% of total ETF flows, with their market share growing at an impressive 34%, steadily eroding the dominance of passive ETFs.

This growth trajectory signals a major evolution in the ETF landscape, with investors increasingly gravitating toward active management to achieve tailored and adaptive strategies in a rapidly changing market.

What’s Next in 2025?

As we close the book on a record-shattering 2024, the stage is set for even greater advancements in 2025 and beyond. The ETF industry is poised to see continued growth in crypto-focused products, with upcoming requests in other crypto funds such as Spot Solana and “Crypto Indices”. Conversions of mutual funds and/or SMAs to ETFs are expected to accelerate, reflecting a broader shift in investor preferences toward cost-effective and flexible vehicles. Structured ETFs, offering tailored exposure and risk management, will likely gain further traction as investors seek more sophisticated strategies.

Above all, the ETF market will continue to thrive as a hub of innovation. The year ahead promises to build on 2024’s momentum, ushering in a new era of opportunity and growth.

Citation:

- Industry

- Listings: https://x.com/etfgi/status/1867151857128505760

- Inflows & assets: https://x.com/etfgi/status/1867273487997624533

- Aum growth rate: https://x.com/EricBalchunas/status/1867217031923458278

- $1T US assets: https://x.com/ICI/status/1866528538339447055

- IVV & VOO: https://www.morningstar.com/funds/etf-flows-punctuate-record-year-december

- Bitcoin

- Single stock

- Launch % increase: Morningstar data

- 1b to 20b: https://x.com/EricBalchunas/status/1866924290538606862

- Active ETFs

- 78%: Morningstar data — (524 out of 667)

- 295b flow: https://www.morningstar.com/funds/etf-flows-punctuate-record-year-december

- 33% organic flows: https://www.morningstar.com/business/insights/blog/funds/global-fund-flows