Here’s what you should consider first.

Our enduring fascination with active management in ETFs is not just a story – it’s backed by the latest Global ETF Survey. Conducted annually by Trackinsight, this year in partnership with J.P. Morgan and State Street, the survey reveals that global active ETF assets have surged four-fold in the past four years. Both product providers and allocators are fueling this growth.

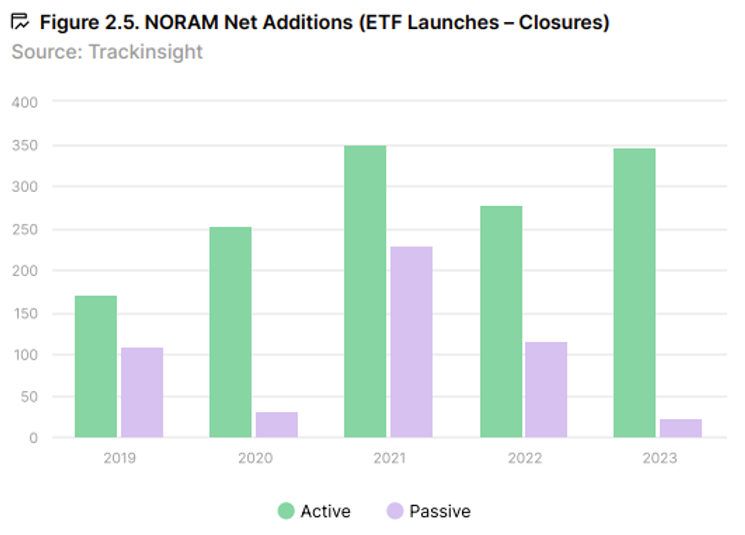

The report, “Global ETF Survey 2024: 50+ Charts on Worldwide ETF Trends,” vividly portrays a thriving global industry, with active management taking center stage. For instance, the rise in net launches of active ETFs compared to passive ones in North American markets in 2023 is remarkable, underscoring the momentum of active management.

Source:

Underscoring the significance of that spread is the fact that in the past year, we’ve seen our ETF open-to-close ratio drop to about 2 from as high as 5, meaning that for every 2 ETFs that open, 1 closes – a maturing industry that’s been welcoming a lot more active ETFs.

Allocation Trends

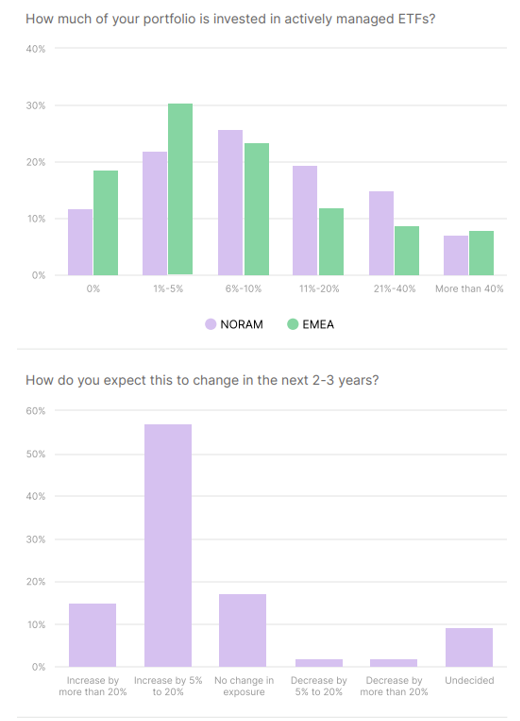

Meanwhile, allocators are taking a closer look at actively managed ETFs and increasing their allocations to them, as the charts below show.

Source:

Plot Twist?

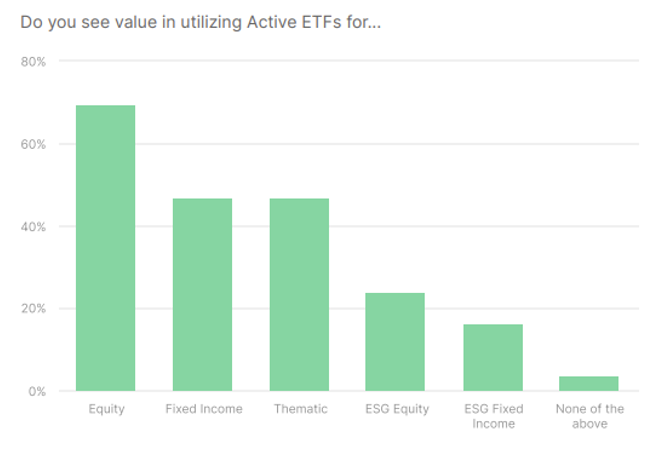

One interesting wrinkle deeper in the numbers is where active is seen as delivering value. For example, the survey found that about 73% of advisors either invest in or have a “keen interest” in active ETFs, but many report that active management has delivered value-add mostly in equities – not fixed income or alternatives or something else. That perception of value is striking given the long historical track record of passive vs. active equity funds.

These adoption trends are especially interesting because when it comes to actively managed ETFs in North America, it’s performance that leads decision-making and product choice, not the pursuit of diversification as is the case in EMEA region. So, advisors are finding – or chasing – outperformance in active ETFs and finding that value mostly in the equity space.

Looking Ahead

One possible implication of these findings is that we may have not yet tapped the potential for active management to deliver value across the ETF marketplace.

If you consider that advisors have yet to fully embrace active management across other asset classes, but a lot of product development is happening exactly there – in fixed income, in alternatives and in packaged one-ticker solutions – it could be that we have a lot more product development ahead of us, and more importantly, a lot more unlocking of value in the active ETF wrapper itself.